Understanding dwelling coverage in home insurance takes center stage with a comprehensive look at what it entails, from coverage details to factors influencing it, and how to calculate the right amount. Dive into this insightful guide for a deeper understanding.

Understanding Dwelling Coverage

Dwelling coverage in home insurance refers to the part of the policy that protects the physical structure of your home, including the walls, roof, foundation, and other attached structures. It is essential to have adequate dwelling coverage to ensure that your home can be repaired or rebuilt in the event of damage from covered perils.

Examples of Covered Items under Dwelling Coverage:

- Roof damage from a storm

- Fire damage to the walls

- Structural damage from a fallen tree

The Importance of Adequate Dwelling Coverage:

Having adequate dwelling coverage is crucial to safeguarding your most significant investment – your home. In the event of a disaster, such as a fire or severe weather, having enough coverage can make all the difference in being able to repair or rebuild your home without facing significant financial burden. It is important to regularly review and update your dwelling coverage to ensure it reflects the current value of your home and any improvements or renovations that have been made.

Factors Influencing Dwelling Coverage

When determining the amount of dwelling coverage needed in a home insurance policy, several factors come into play. These factors include the location of the property, the age and condition of the home, and other specific characteristics of the dwelling. Understanding these factors is crucial in ensuring that you have adequate coverage to protect your investment in case of unexpected events.

Location Impact on Dwelling Coverage Requirements

The location of a property plays a significant role in determining the dwelling coverage requirements. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or wildfires may require higher coverage limits to account for potential damages. Additionally, properties in high-crime areas may also need increased coverage to safeguard against theft or vandalism. It is essential to consider the specific risks associated with the location of the property when setting dwelling coverage limits.

Age and Condition of the Home Affect Dwelling Coverage

The age and condition of a home can impact the amount of dwelling coverage needed in a home insurance policy. Older homes may require higher coverage limits due to the potential for aging infrastructure, outdated wiring, or plumbing issues that could lead to costly repairs or replacements. Similarly, homes in poor condition, with structural damage or pre-existing issues, may also necessitate increased coverage to address these concerns. Evaluating the age and condition of the home is crucial in determining the appropriate dwelling coverage limits to adequately protect your investment.

Coverage Limits and Exclusions: Understanding Dwelling Coverage In Home Insurance

When it comes to dwelling insurance, understanding the coverage limits and exclusions is crucial to ensure you have adequate protection for your home. Here, we will detail common coverage limits for dwelling insurance, discuss exclusions that are typically not covered, and provide examples of situations where coverage limits may come into play.

Coverage Limits

- Most dwelling insurance policies have a coverage limit that represents the maximum amount the insurance company will pay out for a covered loss. This limit is typically based on the value of your home and can vary depending on the policy.

- There may also be sub-limits for specific items or events, such as jewelry, electronics, or natural disasters. It’s important to review these limits to ensure you have adequate coverage for your belongings and potential risks.

- Some policies may offer extended replacement cost coverage, which provides additional coverage beyond the policy limit to rebuild your home in case of a total loss. This can be a valuable add-on for extra protection.

Exclusions

- Exclusions are situations or events that are typically not covered under dwelling insurance. Common exclusions include damage caused by floods, earthquakes, acts of war, and normal wear and tear.

- Maintenance-related issues, such as mold, pest infestations, and gradual deterioration, are also commonly excluded from coverage. It’s important to understand these exclusions and consider additional coverage if needed.

- Personal liability coverage for injuries or damages to others is typically not included in dwelling insurance and may require a separate policy or endorsement for full protection.

Examples of Coverage Limits in Action, Understanding dwelling coverage in home insurance

- If your home is insured for $300,000 and a fire causes $400,000 in damages, you would be responsible for the $100,000 difference if there is no extended replacement cost coverage.

- In the event of a flood that damages your home, if flood damage is excluded from your policy, you would not receive any coverage for the repair costs unless you have a separate flood insurance policy.

- If a valuable piece of jewelry worth $10,000 is stolen and your policy has a sub-limit of $5,000 for jewelry, you would only be reimbursed up to that limit unless you have additional coverage in place.

Calculating Dwelling Coverage

When it comes to calculating dwelling coverage for your home insurance policy, it is essential to determine the appropriate amount of coverage to protect your property adequately. This involves considering factors such as the size of your home, construction costs in your area, and any upgrades or renovations that have been done.

Difference between Actual Cash Value and Replacement Cost Coverage

- Actual Cash Value: This type of coverage takes depreciation into account when reimbursing you for a covered loss. This means that you will receive the current value of your property, which may be lower than what you originally paid for it.

- Replacement Cost Coverage: With this type of coverage, you will be reimbursed for the full cost of repairing or replacing your property without deducting for depreciation. This ensures that you can rebuild or repair your home to its original condition.

How Upgrades or Renovations Affect Dwelling Coverage Calculations

When you make upgrades or renovations to your home, it is important to reassess your dwelling coverage to ensure that you have adequate protection. These improvements can increase the value of your property, which may require adjusting your coverage limits to reflect the new replacement cost. Failing to update your coverage after renovations could leave you underinsured in the event of a claim.

In conclusion, having a clear grasp of dwelling coverage in home insurance is crucial to ensure adequate protection for your property. By considering the factors, limits, and calculations involved, you can make informed decisions to safeguard your home effectively.

Understanding condo insurance coverage is crucial for every condo owner. This type of insurance typically covers your personal belongings, liability protection, and additional living expenses in case of a covered event. To learn more about condo insurance coverage, check out this detailed guide: Condo insurance coverage explained.

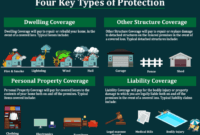

When it comes to home insurance, there are various types of coverage to consider. From dwelling coverage to personal property protection, it’s important to understand what each policy includes. To explore the different types of home insurance coverage in more detail, visit: Types of home insurance coverage.

Homeowners insurance policies come in different forms, such as HO-1, HO-2, HO-3, and more. Each policy offers unique coverage options and benefits, catering to different homeowner needs. To find out more about the types of homeowners insurance policies available, click here: Types of homeowners insurance policies.