Delving into Renters insurance vs homeowners insurance, this introduction immerses readers in a unique and compelling narrative, with engaging and thought-provoking insights from the very beginning. When it comes to protecting your assets and property, understanding the differences between renters insurance and homeowners insurance is crucial.

Throughout this guide, we will explore the key disparities in coverage, cost factors, property protection, and liability coverage between renters insurance and homeowners insurance, providing you with a clear understanding of which option may be more suitable for your specific needs.

Overview of Renters Insurance and Homeowners Insurance

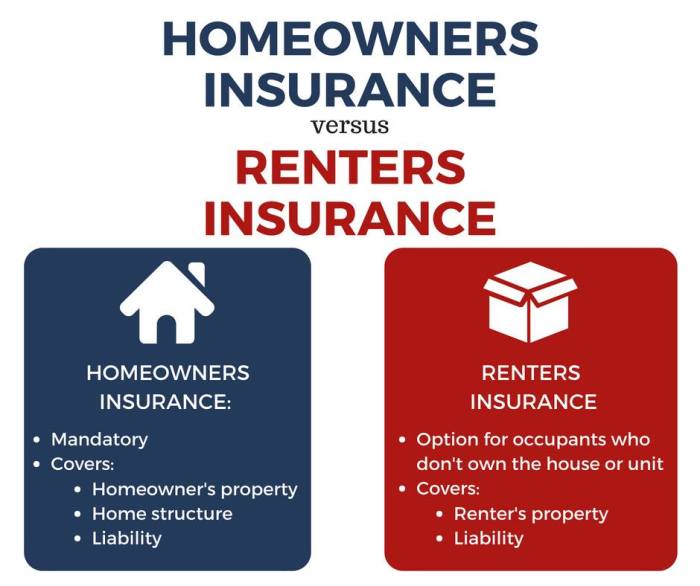

Renters insurance and homeowners insurance are two types of property insurance that provide coverage for individuals living in rented properties and those who own their homes, respectively. While both types of insurance protect against unforeseen events that can damage or destroy property, there are key differences in coverage and target audience.

Fundamental Differences

- Renters Insurance: Designed for tenants renting a property, renters insurance typically covers personal belongings, liability protection, and additional living expenses in case the rental becomes uninhabitable due to covered events.

- Homeowners Insurance: Geared towards homeowners, this type of insurance covers the structure of the home, personal belongings, liability protection, and additional living expenses. It also includes coverage for detached structures on the property.

Scenarios

- Renters Insurance: Necessary for tenants who want to protect their personal belongings and have liability coverage in case someone is injured on the property they are renting.

- Homeowners Insurance: More suitable for individuals who own their homes and want to protect their investment, including the structure of the house and personal belongings.

Key Similarities

- Both renters and homeowners insurance provide liability coverage, protecting policyholders in case someone is injured on their property.

- Both types of insurance offer coverage for additional living expenses if the property becomes uninhabitable due to covered events, such as a fire or natural disaster.

Coverage Offered

When it comes to insurance, understanding the coverage offered is crucial in determining the level of protection provided. Renters insurance and homeowners insurance both offer different types of coverage to policyholders. Let’s delve into the specifics of each.

Types of Coverage in Renters Insurance Policies

Renters insurance typically includes the following types of coverage:

- Personal Property Coverage: This protects your belongings, such as furniture, electronics, and clothing, in case of theft, fire, or other covered perils.

- Liability Coverage: This provides protection if someone is injured while on your rental property and you are found liable.

- Additional Living Expenses Coverage: In the event that your rental becomes uninhabitable due to a covered loss, this coverage helps with temporary living expenses.

Coverage Options in Homeowners Insurance Policies

Homeowners insurance policies offer a wider range of coverage options compared to renters insurance, including:

- Dwelling Coverage: This protects the structure of your home, including the walls, roof, and foundation, against covered perils like fire, windstorm, and vandalism.

- Other Structures Coverage: Covers detached structures on your property, such as a garage or shed.

- Personal Property Coverage: Similar to renters insurance, this coverage protects your belongings inside your home.

- Liability Coverage: Offers financial protection in case someone is injured on your property and you are held responsible.

- Additional Living Expenses Coverage: Helps cover the cost of temporary accommodations if your home is uninhabitable due to a covered loss.

Comparison of Coverage Limits

When it comes to coverage limits, homeowners insurance policies typically have higher limits compared to renters insurance policies. This is because homeowners insurance not only covers the structure of the home but also the land it sits on, which tends to be more valuable. Additionally, homeowners insurance often includes higher liability limits to protect against potential lawsuits.

In contrast, renters insurance coverage limits are generally lower since it primarily focuses on protecting personal belongings and liability rather than the physical structure of the property. Renters may need to consider additional coverage options if they have high-value items that exceed the standard policy limits.

Cost Factors

When it comes to renters insurance, several factors can influence the cost of coverage. These can include the location of the rental property, the amount of coverage needed, the deductible chosen, personal factors such as credit score, and even the type of building being rented.

When it comes to landscaping, garden sculptures play a crucial role in enhancing outdoor spaces with artistic designs. These sculptures not only add a touch of elegance to your garden but also create a focal point that draws attention. Whether it’s a classical statue or a modern abstract piece, garden sculptures can transform any outdoor area into a work of art.

Check out some inspiring garden sculptures for landscaping Enhancing Outdoor Spaces with Artistic Designs to elevate your garden decor.

Factors Influencing Renters Insurance Cost

- The location of the rental property can impact the cost of renters insurance. Properties in high-crime areas or regions prone to natural disasters may have higher premiums.

- The amount of coverage needed will also affect the cost. Higher coverage limits will result in higher premiums.

- The deductible chosen plays a significant role. Opting for a higher deductible can lower monthly premiums.

- Personal factors like credit score can impact the cost of renters insurance. A higher credit score may result in lower premiums.

- The type of building being rented, such as a single-family home or an apartment in a multi-unit building, can also influence the cost of coverage.

Determining Homeowners Insurance Cost, Renters insurance vs homeowners insurance

When it comes to homeowners insurance, the cost is determined by various factors. These include the location of the home, the age and condition of the home, the coverage limits and deductible chosen, the materials used in construction, and even the homeowner’s credit score.

Cost-Saving Strategies

- For renters insurance, bundling policies with the same insurance provider can often result in discounts.

- Opting for a higher deductible can lower monthly premiums for both renters and homeowners insurance.

- Installing security features in the rental property or home, such as alarm systems or deadbolts, can lead to discounts on insurance premiums.

- Regularly reviewing and updating coverage limits to ensure they align with current needs can prevent overpaying for insurance.

Property Protection: Renters Insurance Vs Homeowners Insurance

When it comes to property protection, both renters insurance and homeowners insurance play a crucial role in safeguarding personal belongings and the physical structure of the property. Let’s delve into how each type of insurance provides this essential coverage.

Renters Insurance: Protecting Personal Property

Renters insurance is designed to protect personal belongings within a rental property. This includes items such as furniture, electronics, clothing, and other valuable possessions. In the event of covered perils like theft, fire, or water damage, renters insurance can help replace or repair these items, providing financial compensation to the policyholder.

- Renters insurance typically covers personal property both inside the rental unit and even when items are temporarily outside the home, such as when traveling.

- It’s important for renters to take inventory of their belongings and assess their value to ensure adequate coverage under their policy.

- While renters insurance does not cover the physical structure of the rental property, it offers essential protection for personal possessions, giving tenants peace of mind.

Homeowners Insurance: Coverage for Structure and Belongings

Homeowners insurance goes a step further by not only protecting personal belongings but also covering the physical structure of the home. This includes the house itself, as well as other structures on the property like a garage or shed. In addition to property protection, homeowners insurance offers liability coverage in case someone is injured on the property.

- Homeowners insurance policies provide coverage for both personal property and the structure of the home in the event of damage or loss due to covered perils.

- It’s essential for homeowners to review their policy limits and ensure they have adequate coverage to rebuild or repair their home in case of a disaster.

- With homeowners insurance, policyholders can rest assured that their property and belongings are protected against a wide range of risks.

Differences in Property Protection

The primary difference in property protection between renters insurance and homeowners insurance lies in the coverage of the physical structure. While renters insurance focuses solely on personal belongings within the rental unit, homeowners insurance provides comprehensive coverage for both the structure of the home and personal possessions. Renters may opt for additional coverage if they wish to protect the structure of the rental property, although this is not typically included in standard renters insurance policies.

Liability Coverage

:max_bytes(150000):strip_icc()/whats-difference-between-renters-insurance-and-homeowners-insurance-v2-2694bc76e944405aa55fe2784c373999.png?w=700)

When it comes to renters insurance, liability coverage is a crucial component that protects you in case someone is injured on your rented property. This coverage can help cover medical expenses and legal fees if you are found responsible for the injury.

Liability Coverage in Renters Insurance

- Renters insurance typically includes liability coverage that ranges from $100,000 to $500,000.

- This coverage can protect you if someone is injured in your rental unit or if you accidentally damage someone else’s property.

- For example, if a guest slips and falls in your apartment and sues you for medical expenses, liability coverage can help cover those costs.

Liability Protection in Homeowners Insurance

- Homeowners insurance also includes liability coverage, usually starting at around $100,000.

- This coverage extends beyond your property to protect you if someone is injured on your premises or if you accidentally damage someone else’s property.

- For instance, if a visitor trips on your front porch and sustains injuries, your homeowners insurance liability coverage can help pay for their medical bills.

Examples of Liability Coverage Scenarios

- In a renters insurance scenario, if your dog bites a neighbor while on a walk, resulting in medical expenses and a potential lawsuit, liability coverage can help cover these costs.

- For homeowners insurance, if a tree in your yard falls on your neighbor’s car during a storm, causing damage, your liability coverage can assist in paying for the repairs.

In conclusion, Renters insurance and homeowners insurance each have their own advantages and considerations. Whether you are renting a property or own a home, being informed about the nuances of these insurance options can help you make a well-informed decision to protect your investments and assets.

Transforming your outdoor space with style can be easily achieved with the right outdoor wall decor ideas. From hanging planters to metal artwork, the options are endless when it comes to adding personality to your outdoor walls. Whether you prefer a minimalist look or a vibrant display, there are plenty of creative ideas to choose from. Explore some innovative outdoor wall decor ideas Transforming Your Outdoor Space with Style to give your outdoor area a fresh new look.

Enhancing your garden with a pergola is a great way to elevate your outdoor space with style. Pergolas not only provide shade and shelter but also add a touch of sophistication to your garden design. Whether you’re looking for a cozy retreat or a stylish entertaining area, pergolas come in various designs to suit your needs. Discover some inspiring pergola design ideas for garden Enhancing your outdoor space with style to create a stunning outdoor oasis.