Options trading strategies takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Options trading has become a popular way to potentially boost investment returns by utilizing various strategies. In this guide, we will delve into the intricacies of options trading and explore different techniques to maximize profits and manage risks effectively.

Options Trading Basics

Options trading is a type of investment strategy that involves buying and selling options contracts on the stock market. An options contract gives the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price before a certain date.

Learning how to trade stocks online is a valuable skill for investors looking to capitalize on market opportunities. Beginners can benefit from step-by-step tutorials and expert tips on platforms like How to trade stocks online.

Call and Put Options

There are two main types of options: call options and put options. Call options give the holder the right to buy the underlying asset at a specified price, known as the strike price, before the expiration date. Put options, on the other hand, give the holder the right to sell the underlying asset at a specified price before the expiration date.

Successful stock trading strategies are essential for maximizing profits and minimizing risks. Traders can explore various techniques and tools to enhance their performance, such as the ones highlighted in Stock trading strategies guide.

For example, if you buy a call option on a stock with a strike price of $50 and the stock price rises to $60 before the expiration date, you can exercise your option to buy the stock at $50 and then sell it at the market price of $60, making a profit. Similarly, if you buy a put option on a stock with a strike price of $100 and the stock price falls to $90 before the expiration date, you can exercise your option to sell the stock at $100, even though the market price is $90, thus locking in a profit.

When it comes to online stock trading platforms, it’s crucial to choose one that suits your needs and preferences. Some popular options include Online stock trading platforms that offer user-friendly interfaces and advanced features for seamless trading.

Common Options Trading Strategies

When engaging in options trading, there are several popular strategies that traders can utilize to manage risk and potentially maximize profits. Two common strategies are covered calls and protective puts. Let’s delve into how each of these strategies works and when they are most effectively used.

Covered Calls

A covered call strategy involves selling a call option on an asset that you already own. This strategy is typically used when the trader is neutral to moderately bullish on the underlying asset. By selling a call option, the trader collects a premium, which provides some downside protection if the price of the asset falls. However, the potential profit from the asset’s price increase is limited to the strike price of the call option.

Protective Puts

On the other hand, a protective put strategy involves purchasing a put option on an asset that you own. This strategy is used to protect against potential downside risk in the asset’s price. If the price of the asset falls, the put option increases in value, offsetting some or all of the losses on the asset. However, the cost of purchasing the put option reduces the overall profit potential.

By comparing and contrasting these two strategies, traders can evaluate the risk and reward profiles of each. Covered calls offer limited upside potential but provide some downside protection, while protective puts offer downside protection but reduce potential profits. Traders should consider their market outlook and risk tolerance when choosing between these strategies.

Advanced Options Trading Techniques

When it comes to advanced options trading techniques, traders often turn to strategies like straddles, strangles, and spreads to capitalize on market movements and maximize profits. These techniques involve more complex combinations of buying and selling options to create specific risk and reward profiles.

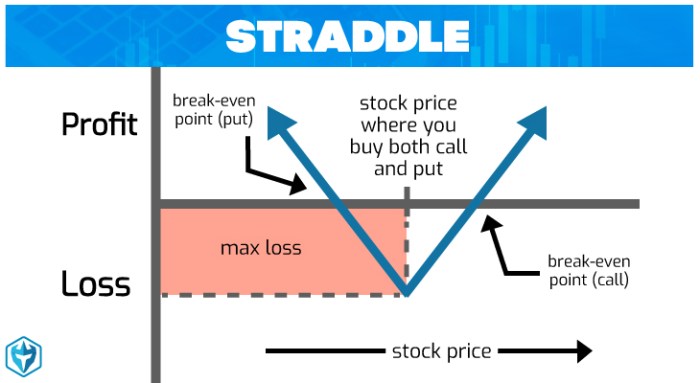

Straddles

A straddle involves buying both a call option and a put option with the same strike price and expiration date. This strategy is used when a trader expects a significant price movement but is unsure of the direction. By combining a long call and a long put, the trader profits from the stock moving either up or down, as long as the movement is significant enough to cover the cost of both options.

Strangles

Similar to a straddle, a strangle involves buying both a call option and a put option. However, in a strangle, the strike prices of the options are different. This strategy is used when a trader expects a significant price movement but is more confident about the direction. By buying out-of-the-money options, the trader can potentially profit from a large price swing in either direction.

Spreads

Spreads are advanced options trading strategies that involve simultaneously buying and selling options on the same underlying asset. There are different types of spreads, including vertical spreads, horizontal spreads, and diagonal spreads. These strategies are used to either limit risk, reduce upfront costs, or benefit from specific market conditions.

Risk Management in Options Trading: Options Trading Strategies

When it comes to options trading, risk management is a crucial aspect that can make or break your success in the market. Proper risk management strategies are essential to protect your capital and maximize your potential profits.

Importance of Risk Management, Options trading strategies

Effective risk management helps traders avoid significant losses and ensures they can continue trading even after a series of unsuccessful trades. By implementing risk management techniques, traders can protect their investment capital and maintain a sustainable trading strategy.

- Setting Stop Loss Orders: One common risk management technique is to set stop loss orders to limit potential losses on a trade. This allows traders to define the maximum amount they are willing to lose on a trade before exiting the position.

- Diversification: Diversifying your options trades across different underlying assets or strategies can help spread risk and reduce the impact of any single trade on your overall portfolio.

- Position Sizing: Properly sizing your positions based on your risk tolerance and account size is crucial for managing risk effectively. Avoid risking too much of your capital on a single trade.

Calculating and Limiting Risk

When trading options, it’s important to calculate and limit your risk exposure to protect your capital. One way to do this is by understanding the concept of maximum risk and adjusting your position size accordingly to stay within your risk tolerance level.

Calculating Risk: Risk in options trading can be calculated using the options greeks, such as delta, gamma, theta, and vega, to determine the potential impact of price changes on your options positions.

Minimizing Potential Losses

To minimize potential losses in options trading, consider implementing the following strategies:

- Regularly review and adjust your risk management plan based on market conditions and your trading performance.

- Avoid risking more than a small percentage of your total trading capital on any single trade.

- Consider using protective strategies like buying protective puts or selling covered calls to hedge against potential losses.

In conclusion, mastering options trading strategies can open up a world of opportunities for investors. By implementing the right techniques and risk management practices, traders can navigate the complexities of the options market with confidence and achieve their financial goals.