How to trade stocks online sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with ahrefs author style and brimming with originality from the outset.

Online stock trading has revolutionized the way individuals engage with financial markets, providing convenience and accessibility like never before. As you delve into the world of trading stocks online, you’ll uncover a myriad of opportunities and strategies to navigate this dynamic landscape with confidence and expertise.

Overview of Online Stock Trading

Online stock trading refers to the process of buying and selling stocks through an internet-based platform. This method allows investors to trade stocks from anywhere at any time, providing convenience and accessibility.

Streamlining your investment process is key to success in real estate. With the help of real estate investment software like Real estate investment software Streamlining Your Investment Process , investors can analyze data, track performance, and manage their portfolios more efficiently. Stay ahead of the curve with advanced tools and technology.

Benefits of Trading Stocks Online

- Convenience: Online trading allows investors to trade stocks from the comfort of their own homes or offices without the need to visit a physical location.

- Lower Costs: Online trading typically involves lower fees and commissions compared to traditional methods, saving investors money in the long run.

- Real-Time Monitoring: Online platforms provide real-time updates on stock prices, market trends, and news, allowing investors to make informed decisions quickly.

- Greater Control: Investors have more control over their trades with online platforms, as they can execute trades instantly without the need for a broker.

Comparison with Traditional Methods

Traditional stock trading methods often involve phone calls or in-person visits to a broker or financial institution to execute trades. This can be time-consuming and may result in higher fees and commissions. Online trading, on the other hand, offers greater flexibility, lower costs, and real-time access to market information, making it a popular choice among investors.

When it comes to real estate investing, having the right knowledge is crucial. That’s why finding the best books on real estate investing is essential for any investor. Explore top recommendations and strategies through resources like Best books on real estate investing Top Recommendations and Strategies to enhance your understanding and make informed decisions in the market.

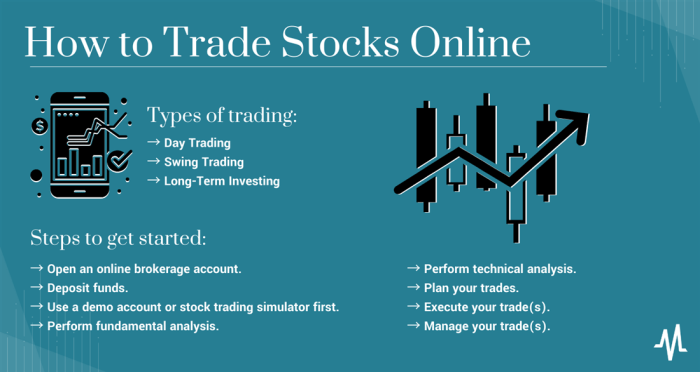

Getting Started

To begin trading stocks online, there are a few basic requirements and steps you need to follow.

Identifying Basic Requirements

- Internet Connection: A stable internet connection is essential for online stock trading to ensure timely execution of trades.

- Computer or Mobile Device: You will need a device such as a computer or smartphone to access the online brokerage platform.

- Funds for Investment: You should have sufficient funds available to invest in stocks through your online trading account.

Choosing a Reliable Online Brokerage Platform

When selecting an online brokerage platform for stock trading, consider the following factors:

- Regulation: Ensure that the platform is regulated by a reputable financial authority to protect your investments.

- Trading Fees: Compare the commission and fees charged by different platforms to find one that offers competitive rates.

- User-Friendly Interface: Look for a platform with an intuitive interface and easy navigation to make trading convenient.

- Research Tools: Choose a platform that provides research tools, market analysis, and real-time data to help you make informed trading decisions.

Opening an Online Trading Account

The process of opening an online trading account typically involves the following steps:

- Choose a Broker: Select a reputable online brokerage firm that meets your trading requirements.

- Complete Application: Fill out the online application form with your personal and financial details.

- Verify Identity: Upload identification documents such as a driver’s license or passport to verify your identity.

- Fund Your Account: Deposit funds into your trading account through bank transfer, credit/debit card, or other payment methods accepted by the brokerage.

- Start Trading: Once your account is approved and funded, you can start buying and selling stocks online through the trading platform.

Stock Market Fundamentals

Before diving into online stock trading, it is crucial to understand key stock market fundamentals that will provide a solid foundation for your investment journey.

Real estate crowdfunding for commercial investments is revolutionizing the way investors access commercial real estate opportunities. By utilizing platforms like Real estate crowdfunding for commercial investments Revolutionizing the way investors access commercial real estate opportunities , investors can diversify their portfolios and participate in projects that were once only accessible to large institutions.

Key Stock Market Terminologies

Here are some essential terms you need to know:

- Stocks: Represent ownership in a company and can be bought and sold on the stock market.

- Shares: Units of stock that investors can purchase.

- Dividends: Payments made by companies to their shareholders as a portion of their profits.

The Importance of Research in Trading

Conducting thorough research is vital before making any investment decisions. Here’s why:

- Research helps you understand the financial health of a company and its growth potential.

- It enables you to make informed decisions based on data and analysis rather than emotions.

- Research allows you to identify trends and patterns in the stock market, helping you anticipate market movements.

Reading Stock Market Charts and Interpreting Data

Understanding how to read stock market charts and interpret data is essential for successful trading. Here are some key points:

- Stock charts display the price movement of a stock over a specific period, helping you identify trends and patterns.

- Common indicators on stock charts include moving averages, relative strength index (RSI), and volume, which provide valuable insights into market sentiment.

- Interpreting stock data involves analyzing financial reports, company news, and market trends to make informed decisions about buying or selling stocks.

Strategies for Successful Trading

Developing a solid trading plan is crucial for success in the stock market. It helps you stay disciplined, manage risk, and make informed decisions based on your goals and risk tolerance. Here are some tips for creating an effective trading plan:

Day Trading vs. Swing Trading

- Day Trading: Involves buying and selling stocks within the same trading day. It requires quick decision-making, technical analysis skills, and the ability to handle high volatility.

- Swing Trading: Involves holding stocks for a few days to weeks to capture short- to medium-term gains. It requires a more patient approach and the ability to analyze both technical and fundamental factors.

Risk Management in Stock Trading

Risk management is essential to protect your capital and minimize losses in stock trading. Here are some key principles to consider:

- Set Stop-Loss Orders: Determine the maximum amount you are willing to lose on a trade and set stop-loss orders to automatically sell your position if the price reaches that level.

- Diversify Your Portfolio: Spread your investments across different stocks, sectors, and asset classes to reduce risk and avoid putting all your eggs in one basket.

- Use Proper Position Sizing: Avoid risking more than a small percentage of your total capital on any single trade to prevent significant losses that could wipe out your account.

- Stay Informed: Keep up with market news, economic indicators, and company developments to make informed decisions and adjust your trading strategy as needed.

Executing Trades

When it comes to buying and selling stocks online, the process is relatively straightforward but requires attention to detail. Investors make use of online trading platforms to execute their trades efficiently and effectively. Understanding the types of orders available and when to use them is crucial for successful trading.

Types of Orders

- Market Orders: These orders are executed at the best available price in the market. They are typically used when the investor wants to buy or sell a stock quickly without being concerned about the exact price.

- Limit Orders: With limit orders, investors set a specific price at which they are willing to buy or sell a stock. This allows for more control over the price at which the trade is executed.

- Stop Orders: Stop orders are used to limit losses or protect profits. They are triggered when the stock reaches a certain price, at which point the order becomes a market order.

Online Trading Platforms

Online trading platforms play a crucial role in executing trades efficiently. These platforms provide real-time market data, research tools, and order placement capabilities. They also offer a user-friendly interface that allows investors to monitor their portfolios and execute trades with ease. By utilizing online trading platforms, investors can stay informed and react quickly to market changes, ultimately improving their trading performance.

Monitoring and Analyzing Stocks: How To Trade Stocks Online

Monitoring and analyzing stocks is a crucial aspect of successful online trading. By keeping track of stock performance and conducting thorough analysis, traders can make informed decisions and maximize their profits.

Tracking Stock Performance

Tracking stock performance involves monitoring price movements, volume trends, and other key indicators to assess the health of a particular stock. Here are some tips on how to effectively track stock performance:

- Use stock charts to visualize price movements over time.

- Set up price alerts to stay informed about significant price changes.

- Monitor trading volume to gauge market interest in a stock.

- Keep an eye on key financial ratios and indicators to assess the company’s financial health.

Fundamental and Technical Analysis, How to trade stocks online

Conducting fundamental and technical analysis is essential for understanding the intrinsic value and price trends of a stock. Here’s how you can perform these types of analysis:

- Fundamental Analysis: Evaluate a company’s financial statements, earnings reports, and market position to determine its intrinsic value.

- Technical Analysis: Analyze price charts, patterns, and trading volumes to identify trends and make predictions about future price movements.

Using Tools for Analysis

There are various tools available to help traders analyze stocks more effectively. Some of these tools include:

- Stock Screeners: Filter stocks based on specific criteria such as price, volume, market cap, and more.

- Financial News Sources: Stay updated on market news and trends that can impact stock prices.

- Technical Analysis Software: Utilize software programs to conduct in-depth technical analysis and generate trading signals.

Managing Investments

:max_bytes(150000):strip_icc()/is-it-possible-to-make-a-living-trading-stocks-3140573_final_AC-01-5c06fa1fc9e77c0001ade06b.png?w=700)

Managing investments is crucial for long-term success in stock trading. It involves portfolio diversification, setting investment goals, and knowing when to buy, sell, or hold onto stocks.

Portfolio Diversification and Its Importance

Portfolio diversification is the practice of spreading your investments across various asset classes, industries, and geographic regions to reduce risk. By diversifying your portfolio, you can mitigate the impact of volatility in any single stock or sector.

- Diversify across different industries: Invest in companies from various sectors to avoid overexposure to a single industry’s performance.

- Consider asset allocation: Allocate your investments across stocks, bonds, and other assets based on your risk tolerance and investment goals.

- Geographic diversification: Invest in companies from different countries to reduce the impact of regional economic conditions on your portfolio.

Setting Investment Goals and Adjusting Strategies

Setting clear investment goals is essential for guiding your trading decisions. Your goals will influence your risk tolerance, time horizon, and investment strategies.

- Define your financial objectives: Determine whether you are investing for retirement, education, or wealth accumulation.

- Assess your risk tolerance: Understand how much risk you are willing to take and adjust your investment strategies accordingly.

- Review and adjust regularly: Monitor your portfolio’s performance and make adjustments as needed to align with your investment goals.

Knowing When to Buy, Sell, or Hold Stocks

Deciding when to buy, sell, or hold onto stocks requires a combination of research, analysis, and market knowledge. It is essential to have a clear strategy in place.

- Buy low, sell high: Look for opportunities to purchase stocks at a discounted price and sell them when they reach their full potential.

- Consider market trends: Analyze market trends, company performance, and economic indicators to make informed decisions about buying or selling stocks.

- Have an exit strategy: Define your exit points for each stock in your portfolio to lock in profits or cut losses when necessary.

In conclusion, mastering the art of trading stocks online requires a blend of knowledge, skill, and intuition. By following the insights shared in this guide, you’re well-equipped to embark on your trading journey with a strategic approach and a firm grasp of the intricacies involved. Take charge of your financial future today by implementing these proven strategies and techniques for successful online stock trading.