How to read candlestick charts is crucial for anyone in the trading world. Dive into the fascinating realm of candlestick patterns and unveil the secrets they hold for successful trading strategies.

Candlestick charts have been a staple in the trading world for centuries, offering valuable insights into market dynamics and price movements.

Introduction to Candlestick Charts: How To Read Candlestick Charts

:max_bytes(150000):strip_icc()/UnderstandingBasicCandlestickCharts-01_2-4d7b49098a0e4515bbb0b8f62cc85d77.png?w=700)

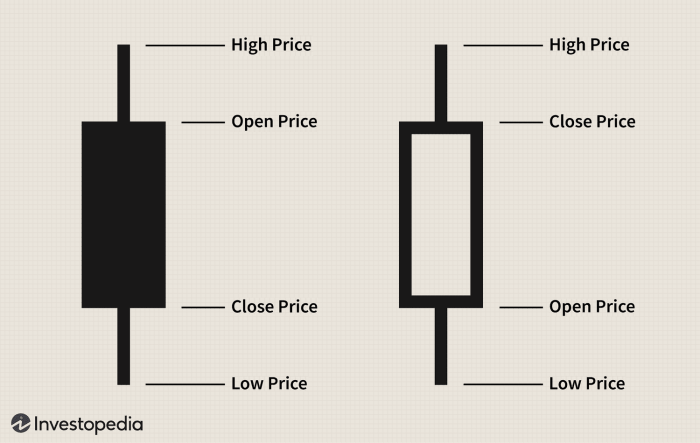

Candlestick charts are a type of financial chart used to represent the price movements of an asset. They visually display the open, high, low, and close prices over a specific period, typically in the form of a candlestick shape.

Candlestick charts originated in Japan during the 18th century when traders used them to track the price of rice. The method was later introduced to the Western world by Steve Nison in his book “Japanese Candlestick Charting Techniques.”

Types of Candlestick Patterns, How to read candlestick charts

- Doji: Represents indecision in the market, with opening and closing prices almost equal.

- Hammer: Signifies a potential reversal in a downtrend, with a small body and long lower shadow.

- Engulfing Pattern: Indicates a reversal in the market sentiment, with one candle completely engulfing the previous one.

- Dark Cloud Cover: Suggests a bearish reversal, formed by a long white candle followed by a black candle that opens above the previous close.

Components of Candlestick Charts

Candlestick charts consist of various components that provide valuable information about price movements in financial markets.

Main Components of a Candlestick

- The Body: The rectangular area between the open and close prices of a trading period. A hollow (or green) body indicates a higher close than open, while a filled (or red) body signifies a lower close than open.

- The Wick/Shadow: The thin lines extending above and below the body, representing the high and low prices reached during the trading period.

- The Color: The color of the body indicates whether the price increased (green) or decreased (red) during the trading period.

Interpreting Wick/Shadow Length and Position

The length and position of the wicks/shadows on a candlestick chart provide crucial information about price movements:

- Long upper wicks indicate that prices moved significantly higher before pulling back, potentially suggesting resistance levels.

- Long lower wicks suggest that prices dropped substantially before recovering, indicating possible support levels.

- Wicks positioned at the top of a candle show that buyers pushed prices higher but encountered selling pressure, while wicks at the bottom indicate sellers pushed prices lower but faced buying support.

Significance of Body Color in Price Interpretation

The color of the body on a candlestick chart plays a key role in interpreting price movements:

- A green (or hollow) body signifies a bullish period, with the closing price higher than the opening price.

- A red (or filled) body indicates a bearish period, where the closing price is lower than the opening price.

- The color of the body provides visual cues to traders about the direction of price movements and market sentiment.

Reading Candlestick Patterns

Candlestick patterns play a crucial role in technical analysis, providing valuable insights into market sentiment and potential price movements. Understanding common patterns like doji, hammer, engulfing, and harami can help traders make informed decisions.

Doji

A doji pattern occurs when the opening and closing prices are virtually the same, resulting in a small body with long wicks. This signifies market indecision and often precedes a reversal in trend.

Hammer

The hammer pattern features a small body at the top of a long lower wick, resembling a hammer. It indicates a potential reversal from a downtrend to an uptrend, with buyers stepping in to push prices higher.

Engulfing

An engulfing pattern occurs when a larger candle completely engulfs the previous candle, signaling a strong shift in market sentiment. A bullish engulfing pattern forms at the end of a downtrend, while a bearish engulfing pattern appears at the end of an uptrend.

Harami

The harami pattern consists of a small candle within the range of the previous large candle. This pattern suggests a potential reversal, with the smaller candle representing indecision in the market.

These candlestick patterns can be powerful tools for traders to anticipate market movements and make well-informed trading decisions. By recognizing these patterns and understanding their implications, traders can gain a competitive edge in the financial markets.

Using Candlestick Charts for Technical Analysis

Candlestick charts are powerful tools for technical analysis in the financial markets. Traders and investors often use candlestick patterns in conjunction with other technical analysis tools to make informed decisions about buying and selling assets.

Identifying Support and Resistance Levels

Support and resistance levels are key areas on a price chart where the price tends to stall or reverse. Candlestick patterns can help traders identify these levels more effectively. For example, a series of bullish candlestick patterns forming near a certain price level may indicate a strong support area, while a cluster of bearish patterns could signal a resistance zone.

- Look for patterns like doji, hammer, or engulfing patterns near support or resistance levels.

- Pay attention to the volume accompanying these patterns to confirm the strength of the support or resistance level.

- Combine candlestick patterns with other technical indicators like trendlines or Fibonacci retracement levels for more robust support and resistance analysis.

Combining Candlestick Patterns with Indicators

Trading indicators like moving averages and the Relative Strength Index (RSI) can provide additional confirmation for candlestick signals. By combining candlestick patterns with these indicators, traders can enhance their analysis and make more informed trading decisions.

- Use moving averages to confirm trend directions indicated by candlestick patterns. A bullish candlestick pattern supported by a moving average crossover can provide a stronger buy signal.

- Incorporate the RSI to gauge the strength of a price move indicated by a candlestick pattern. An oversold RSI reading in conjunction with a bullish reversal pattern could offer a high-probability trading opportunity.

- Remember to consider multiple indicators and not rely solely on candlestick patterns for your trading decisions. A combination of different tools can provide a more comprehensive analysis of market conditions.

Mastering the art of reading candlestick charts can be a game-changer for traders, enabling them to make informed decisions and stay ahead of market trends. Embrace the power of candlestick patterns and elevate your trading skills to new heights.

When it comes to investing, many people are torn between cryptocurrency and stock trading. While both have their own risks and rewards, it’s essential to understand the differences between the two before diving in.

For those interested in day trading, having solid day trading strategies is crucial for success. Whether you’re a beginner or an experienced trader, having a well-thought-out plan can help minimize risks and maximize profits in this fast-paced market.

Choosing the best stock trading apps can make a significant difference in your trading experience. With the right app, you can access real-time market data, execute trades efficiently, and stay informed about the latest trends in the stock market.