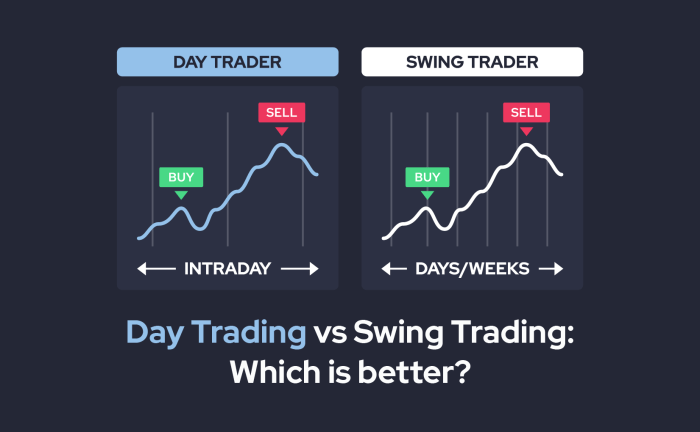

Kicking off with Day trading vs swing trading, this comparison delves into the differences and similarities between two popular trading strategies, offering insights for traders looking to optimize their approach.

Day trading involves buying and selling financial instruments within the same trading day, while swing trading focuses on holding positions for longer periods, typically days to weeks.

Day Trading Overview

Day trading is a type of trading strategy where traders buy and sell financial instruments within the same trading day. This means that all positions are closed before the market closes for the day, with no overnight exposure.

Typical Time Horizon

Day trading involves very short-term trades, usually lasting from a few minutes to a few hours. Traders aim to capitalize on small price movements throughout the day, rather than holding positions for days or weeks.

Popular Day Trading Strategies

- Scalping: A strategy where traders make numerous small trades throughout the day to profit from small price movements.

- Momentum Trading: Traders focus on stocks that are experiencing significant price movements, aiming to capitalize on the momentum.

- Fading: This strategy involves taking positions opposite to the current trend, betting on a reversal in price direction.

- Range Trading: Traders identify key levels of support and resistance and aim to profit from price fluctuations within a specific range.

Swing Trading Overview

Swing trading is a trading strategy that involves holding positions for longer periods than day trading but shorter periods than traditional buy-and-hold investment strategies. Unlike day trading, where positions are opened and closed within the same trading day, swing traders typically hold positions for a few days to weeks.

Timeframes in Swing Trading

In swing trading, traders typically use daily or weekly charts to identify short- to medium-term trends in the market. This allows them to capture price movements over a period of several days to weeks, taking advantage of both up and down swings in the market.

- Swing traders often look for entry and exit points based on technical analysis indicators, such as moving averages, MACD, and RSI.

- They may also consider fundamental analysis factors, such as earnings reports and economic data, to make informed trading decisions.

Common Swing Trading Techniques

Swing traders employ various techniques to capitalize on short- to medium-term price movements in the market. Some common strategies include:

- Trend Following: Swing traders follow the direction of the prevailing trend in the market, entering long positions in uptrends and short positions in downtrends.

- Support and Resistance: Traders identify key support and resistance levels on the price chart and enter trades when the price bounces off these levels.

- Breakout Trading: Traders look for price breakouts from consolidation patterns or chart formations, aiming to capture the momentum of the breakout.

Risk Management in Day Trading: Day Trading Vs Swing Trading

Risk management is a critical aspect of day trading, as the fast-paced nature of this trading style can lead to significant losses if not managed properly. Day traders need to implement strategies to minimize risks and protect their capital effectively. Let’s delve into the importance of risk management for day traders and explore specific strategies to mitigate risks in day trading.

Importance of Risk Management for Day Traders, Day trading vs swing trading

Effective risk management is crucial for day traders to preserve their capital and sustain profitability in the long run. By setting clear risk parameters and adhering to disciplined risk management practices, day traders can avoid catastrophic losses and ensure their trading accounts remain intact.

Strategies for Minimizing Risks in Day Trading

- Set Stop Loss Orders: Day traders should always use stop loss orders to limit potential losses on each trade. This allows traders to exit a losing position before the losses escalate beyond a predetermined threshold.

- Use Proper Position Sizing: Proper position sizing is essential in day trading to ensure that no single trade exposes the trader to excessive risk. Traders should calculate the appropriate position size based on their risk tolerance and stop loss levels.

- Diversify Trades: Diversifying trades across different asset classes or securities can help reduce the overall risk exposure in day trading. By spreading out trades, traders can minimize the impact of any single trade going wrong.

- Avoid Overtrading: Overtrading can lead to emotional decision-making and impulsive trades, increasing the risk of losses. Day traders should stick to their trading plan and avoid the temptation to trade excessively.

Differences in Risk Management Practices between Day Trading and Swing Trading

In day trading, risk management practices are typically more focused on short-term price movements and intraday volatility. Traders need to make quick decisions and closely monitor their positions throughout the trading day. On the other hand, swing trading involves holding positions for longer periods, allowing traders to implement risk management strategies that accommodate overnight or multi-day price fluctuations. The risk management approach in swing trading may involve wider stop loss levels and a more relaxed monitoring of positions compared to day trading.

Market Analysis for Day Trading vs Swing Trading

In the world of trading, market analysis plays a crucial role in guiding traders to make informed decisions. Both day trading and swing trading rely on different types of market analysis to determine when to enter or exit trades.

Types of Market Analysis

- Day Trading:

Day traders primarily focus on technical analysis to study price movements and volume data within a single trading day. They use charts, patterns, and indicators like moving averages, RSI, MACD, and Bollinger Bands to identify short-term trading opportunities. - Swing Trading:

Swing traders combine both technical and fundamental analysis to hold positions for a few days to weeks. They look at trends, support and resistance levels, as well as news and economic reports to make trading decisions.

Indicators and Tools

- Day Trading:

Day traders heavily rely on real-time charts with various time frames, Level 2 market data, and advanced trading platforms. They use tools like Fibonacci retracement levels, candlestick patterns, and momentum oscillators to gauge market direction. - Swing Trading:

Swing traders use similar tools to day traders but on a longer timeframe. They may also incorporate fundamental analysis tools like earnings reports, economic indicators, and company news to make decisions on holding positions for a longer duration.

Influence on Trading Decisions

- Market analysis guides both day traders and swing traders in identifying potential entry and exit points. It helps them manage risk, set stop-loss orders, and determine profit targets based on the analysis of market conditions.

- Day traders make quick decisions based on intraday market movements, while swing traders take a more strategic approach by analyzing broader trends and market sentiment to make trading decisions.

Profit Potential and Time Commitment

Day trading and swing trading both offer different profit potentials and require varying levels of time commitment. Let’s analyze these aspects to understand the differences between the two trading styles.

Profit Potential

When it comes to profit potential, day trading is known for its ability to generate quick profits within a single trading day. Day traders capitalize on small price movements and aim to make multiple trades throughout the day to accumulate profits. On the other hand, swing trading involves holding positions for a longer period, ranging from a few days to weeks, in order to capture larger price movements. While day trading can result in quick profits, swing trading allows traders to benefit from larger price trends. The profit potential in day trading can be higher on a daily basis, but swing trading can lead to substantial profits over time if executed correctly.

Time Commitment

Day trading requires a significant time commitment as traders need to closely monitor the markets throughout the trading day. Day traders typically spend several hours each day analyzing charts, executing trades, and managing positions. Due to the fast-paced nature of day trading, traders need to be actively engaged in the markets to capitalize on short-term opportunities. On the other hand, swing trading requires less time commitment as traders can analyze the markets and make trading decisions outside of market hours. Swing traders typically spend time conducting in-depth analysis to identify potential swing trading opportunities and managing their positions accordingly. This allows for a more flexible schedule compared to day trading.

Scalability of Profits

In terms of scalability, day trading offers the potential for quick and frequent profits due to the high number of trades executed within a single day. However, the scalability of profits in day trading is limited by factors such as market volatility, trading costs, and the trader’s ability to consistently make profitable trades. On the other hand, swing trading allows for the scalability of profits over time as traders hold positions for longer durations to capture larger price movements. Swing traders can benefit from compounding returns on successful trades and diversifying their portfolio to minimize risk. The scalability of profits in swing trading is dependent on the trader’s ability to identify and capitalize on sustainable trends in the market.

Psychological Aspects of Trading

Day trading and swing trading both come with their own set of psychological challenges that traders need to navigate in order to be successful in the market. Let’s delve into the emotional discipline required for each type of trading and compare the psychological aspects of day trading to swing trading.

Emotional Discipline in Day Trading

Day trading can be extremely stressful due to the fast-paced nature of buying and selling securities within the same trading day. Traders need to make quick decisions under pressure, which can lead to emotional highs and lows. Successful day traders must exhibit strong emotional discipline to avoid making impulsive decisions based on fear or greed. It’s crucial to stick to a well-defined trading plan and avoid letting emotions dictate trading actions.

Emotional Discipline in Swing Trading

Swing trading, on the other hand, involves holding positions for a longer period of time, ranging from a few days to a few weeks. While swing traders may not experience the same level of intensity as day traders, they still need to maintain emotional discipline to ride out market fluctuations and avoid making emotional decisions based on short-term price movements. Patience and the ability to stick to a trading strategy are key for successful swing trading.

Comparison of Psychological Aspects

In comparing day trading to swing trading, day trading requires traders to be hyper-focused and make split-second decisions, leading to increased emotional stress. Conversely, swing trading allows for a more relaxed approach, but traders still need to exercise emotional discipline to avoid making rash decisions. Both styles of trading require a high level of self-control and the ability to manage emotions effectively in order to navigate the ups and downs of the market.

Tax Implications

Day traders and swing traders face different tax implications based on the frequency of their trades and the holding period of their assets.

Tax Implications for Day Traders

Day traders are subject to short-term capital gains tax rates on their profits, which are typically higher than long-term capital gains tax rates. This means that any gains made from day trading are taxed at the individual’s ordinary income tax rate. Additionally, day traders are not eligible for certain tax benefits, such as the preferential treatment of long-term capital gains.

Tax Implications for Swing Traders

Swing traders, on the other hand, are subject to long-term capital gains tax rates on their profits if they hold their assets for more than one year. This can result in lower tax rates compared to day traders. Swing traders also have the advantage of being able to take advantage of certain tax benefits, such as the preferential treatment of long-term capital gains.

Tax Planning Strategies

Both day traders and swing traders can benefit from tax planning strategies to minimize their tax liabilities. This may include strategies such as tax-loss harvesting, where traders strategically sell losing positions to offset gains and reduce their overall tax bill. Additionally, traders can consider trading within tax-advantaged accounts, such as IRAs, to defer or avoid taxes on their gains.

In conclusion, understanding the nuances of day trading versus swing trading is crucial for traders to make informed decisions and maximize their profitability in the financial markets.

Real estate crowdfunding for commercial investments is revolutionizing the way investors access commercial real estate opportunities. By utilizing platforms like Real estate crowdfunding for commercial investments Revolutionizing the way investors access commercial real estate opportunities , investors can now diversify their portfolios with ease and transparency.

When it comes to real estate investing, having the right knowledge is crucial. That’s why exploring the best books on real estate investing, such as Best books on real estate investing Top Recommendations and Strategies , can provide valuable insights and strategies for success in the industry.

Streamlining your investment process is essential for success in real estate. Real estate investment software, like Real estate investment software Streamlining Your Investment Process , can help simplify tasks, analyze data, and make informed decisions to maximize profits.