Benefits of real estate investing take the spotlight in this insightful piece, delving into the crucial role it plays in wealth creation. From diversifying portfolios to ensuring long-term financial stability, real estate investment is a powerful tool worth exploring.

Types of investments, tax advantages, and strategic approaches will be unveiled, offering a comprehensive guide to maximizing returns in the real estate market.

Importance of Real Estate Investing

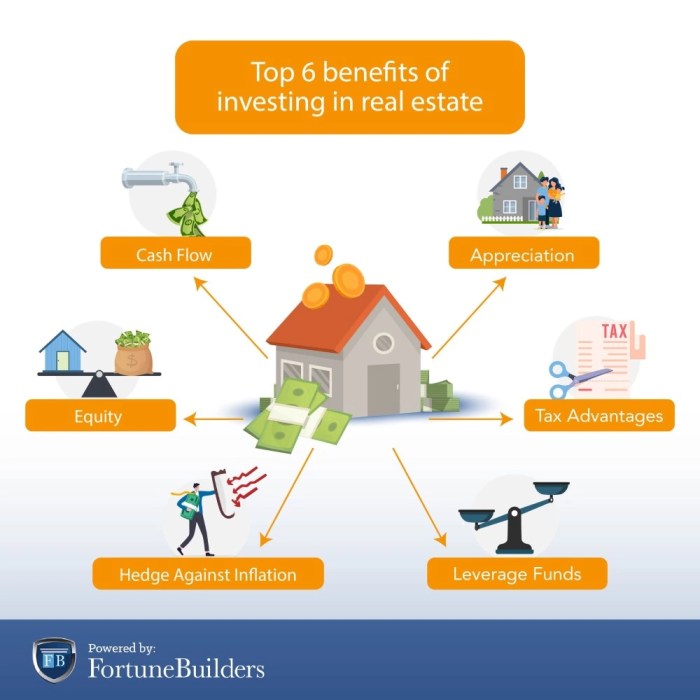

Real estate investing plays a crucial role in building wealth for individuals and businesses alike. Here’s why it is essential:

Diversification of Portfolio

- Real estate investing provides a way to diversify investment portfolios, reducing overall risk. By including real estate assets alongside stocks, bonds, and other investments, investors can spread their risk across different asset classes.

- Diversification through real estate can shield investors from market volatility and economic downturns, as the real estate market often behaves differently from traditional securities markets.

- For example, during periods of economic uncertainty, real estate investments may offer stability and consistent returns compared to stocks or bonds.

Long-Term Financial Security

- Real estate investing offers the potential for long-term financial security through rental income, property appreciation, and tax benefits.

- Rental income from real estate properties can provide a steady stream of passive income, which can supplement other sources of income and support financial goals.

- Property appreciation over time can increase the value of real estate assets, allowing investors to build equity and wealth over the long term.

- Additionally, tax advantages such as depreciation deductions and capital gains tax treatment can enhance the overall financial benefits of real estate investing.

Types of Real Estate Investments

Investing in real estate offers a variety of options for individuals looking to grow their wealth. Understanding the different types of real estate investments can help investors make informed decisions based on their financial goals and risk tolerance.

Residential Properties

Residential properties are homes intended for living purposes, such as single-family houses, condominiums, townhouses, and apartments. Investing in residential properties can provide steady rental income and potential long-term appreciation in value.

Commercial Properties, Benefits of real estate investing

Commercial properties include buildings used for business purposes, such as office buildings, retail spaces, and warehouses. Investing in commercial properties can offer higher rental income than residential properties but may also come with higher maintenance costs and leasing risks.

Industrial Properties

Industrial properties are used for manufacturing, production, storage, and distribution. Examples include factories, warehouses, and distribution centers. Investing in industrial properties can be lucrative due to long-term leases and stable cash flow.

Rental Properties vs. Flipping Properties

Investing in rental properties involves purchasing real estate to generate rental income from tenants. This strategy provides a steady cash flow over time and the potential for property appreciation. On the other hand, flipping properties involves buying properties at a low price, renovating them, and selling them quickly for a profit. While flipping properties can yield high returns in a short period, it also comes with higher risks and requires significant time and effort.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-generating real estate across a range of property sectors. Investing in REITs allows individuals to gain exposure to real estate without directly owning properties. REITs offer liquidity, diversification, and regular income distributions to investors.

Crowdfunding Platforms

Crowdfunding platforms enable investors to pool their resources to invest in real estate projects. These platforms offer opportunities to invest in a diverse range of properties with lower capital requirements. Crowdfunding provides access to real estate investments that may otherwise be out of reach for individual investors, offering potential returns and portfolio diversification.

Tax Advantages of Real Estate Investing

Real estate investing offers various tax benefits that can help investors maximize their returns and reduce their tax liabilities. Let’s explore some of the key tax advantages associated with real estate investments.

Depreciation Deductions

Depreciation allows real estate investors to deduct the cost of the property over its useful life. This non-cash expense can significantly reduce taxable income, resulting in lower tax bills. For example, a property worth $300,000 with a 27.5-year depreciation period can provide an annual depreciation deduction of approximately $10,909.

Mortgage Interest Deductions

Investors can deduct the interest paid on their mortgage loans, reducing their taxable income. This deduction can be substantial, especially in the early years of a mortgage when interest payments are higher. For instance, a $200,000 mortgage with a 4% interest rate could result in annual interest deductions of $8,000.

1031 Exchanges

A 1031 exchange allows investors to defer paying taxes on capital gains when selling a property by reinvesting the proceeds into a similar property. This strategy can help investors grow their portfolio without being burdened by immediate tax obligations, ultimately increasing cash flow for further investments.

Overall, these tax advantages can have a significant impact on the overall returns of real estate investments, making them a tax-efficient way to build wealth and generate passive income.

Real Estate Investment Strategies: Benefits Of Real Estate Investing

Investing in real estate offers a variety of strategies that investors can utilize to achieve their financial goals. Understanding these strategies and choosing the right one for your investment approach is crucial for success in the real estate market.

Buy and Hold Strategy

The buy and hold strategy involves purchasing properties with the intention of holding onto them for the long term. Investors can benefit from rental income while also potentially seeing appreciation in property value over time.

Fix and Flip Strategy

The fix and flip strategy involves purchasing properties that are in need of renovations, making the necessary improvements, and then selling the property for a profit. This strategy can be lucrative but requires careful planning and execution.

Wholesaling Strategy

Wholesaling involves acting as a middleman between sellers and buyers, assigning the contract to another buyer for a fee. This strategy requires strong negotiation skills and a good understanding of the market to be successful.

Rental Property Investing

Investing in rental properties involves purchasing properties with the intention of renting them out to tenants. This strategy can provide a steady stream of passive income but requires careful property management and tenant selection.

Leveraging Other People’s Money (OPM)

One key advantage of real estate investing is the ability to leverage other people’s money to amplify returns. By using financing options such as mortgages or partnerships, investors can increase their purchasing power and potentially see higher profits.

Thorough Market Research and Due Diligence

Before investing in real estate, it is crucial to conduct thorough market research and due diligence. Understanding the local market trends, property values, rental demand, and potential risks can help investors make informed decisions and mitigate potential losses.

In conclusion, the benefits of real estate investing are vast and rewarding, paving the way for financial growth and security. By harnessing the potential of property investments, individuals can secure a prosperous future with confidence.

When it comes to real estate investing, one of the key factors to consider is how to analyze real estate markets. By understanding market trends, property values, and economic indicators, investors can make informed decisions. To learn more about how to analyze real estate markets, check out this comprehensive guide on How to analyze real estate markets.

For those looking to maximize their returns, managing rental property investments is crucial. From finding tenants to handling maintenance issues, effective management is key. If you want to learn more about managing rental property investments, be sure to read this detailed article on Managing rental property investments.

Real estate investing can be intimidating for beginners, but with the right knowledge, anyone can succeed. Understanding the basics of real estate investing is essential for long-term success. If you’re new to real estate investing, this guide on Real estate investing for beginners is a great place to start.