Kicking off with Best stocks to trade today, this opening paragraph is designed to captivate and engage the readers, setting the tone with each word. When it comes to trading stocks, making informed decisions is crucial for success. This guide will walk you through the process of identifying the best stocks to trade today, exploring technical and fundamental analysis, and implementing risk management strategies to protect your investments. Whether you’re a seasoned trader or just starting out, this guide has something for everyone looking to navigate the stock market with confidence.

Identifying the Best Stocks

To find the best stocks to trade today, it is essential to conduct thorough research and analysis. Here are some key factors to consider when selecting stocks for trading:

Company Fundamentals

- Look at the company’s financial health, including revenue growth, earnings per share, and debt levels.

- Consider the industry trends and market position of the company.

- Review the company’s management team and their track record.

Technical Analysis

- Analyze stock charts to identify trends and patterns that can help predict future price movements.

- Use technical indicators like moving averages, MACD, and RSI to make informed trading decisions.

Market News and Sentiment

- Stay updated on market news and events that could impact stock prices.

- Monitor investor sentiment and social media chatter to gauge market sentiment.

Tools and Resources

- Utilize stock screeners like Finviz, TradingView, or Yahoo Finance to filter stocks based on specific criteria.

- Consider using research reports from reputable sources like Morningstar or Seeking Alpha for in-depth analysis.

Technical Analysis

Technical analysis plays a crucial role in identifying potential stocks for trading as it focuses on analyzing historical price and volume data to predict future price movements. By studying charts and using various technical indicators, traders can make informed decisions about when to buy or sell a stock.

Common Technical Indicators

- Moving Averages: Moving averages smooth out price data to identify trends over a specified period. The most common types are the simple moving average (SMA) and the exponential moving average (EMA).

- Relative Strength Index (RSI): RSI measures the speed and change of price movements. It ranges from 0 to 100 and is used to determine overbought or oversold conditions.

- Bollinger Bands: Bollinger Bands consist of a simple moving average and two standard deviations plotted above and below the SMA. They help identify volatility and potential price reversals.

- MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

Interpreting Technical Analysis Charts

- Identify Trends: Look for patterns such as higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend.

- Support and Resistance Levels: These are price levels where a stock tends to find barriers to further movement. Support is a price level where a stock may find buying interest, while resistance is a level where selling interest may emerge.

- Candlestick Patterns: Candlestick patterns provide insights into market sentiment and can indicate potential reversals or continuations in price movements.

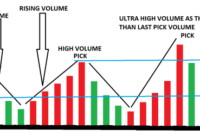

- Volume Analysis: Volume can confirm the strength of a trend. Increasing volume during a price move suggests conviction, while decreasing volume may signal a weakening trend.

Fundamental Analysis: Best Stocks To Trade Today

Fundamental analysis is a crucial aspect of evaluating the health and performance of a company. It involves assessing the company’s financial statements, management team, industry position, and economic outlook to determine the intrinsic value of its stock.

Key Financial Ratios in Fundamental Analysis

Fundamental analysis relies on various financial ratios to gauge the financial health of a company. Some key ratios to consider include:

- Price-to-Earnings (P/E) Ratio: Compares the company’s stock price to its earnings per share, indicating how much investors are willing to pay for each dollar of earnings.

- Debt-to-Equity Ratio: Measures the company’s financial leverage by comparing its total debt to shareholder equity.

- Return on Equity (ROE): Evaluates the profitability of a company by measuring how effectively it is using shareholders’ equity.

- Current Ratio: Assesses the company’s ability to cover its short-term liabilities with its short-term assets.

Impact of News and Economic Factors on Stock Prices

News and economic factors can significantly impact stock prices and trading decisions. For example:

- Positive news like strong earnings reports or new product launches can drive stock prices higher as investors gain confidence in the company’s growth prospects.

- Negative news such as regulatory issues, economic downturns, or poor financial performance can lead to a decline in stock prices as investors become cautious about the company’s future prospects.

- Economic factors like interest rate changes, inflation, and geopolitical events can also influence stock prices by affecting consumer confidence, corporate earnings, and overall market sentiment.

Risk Management Strategies

:max_bytes(150000):strip_icc()/most-popular-stocks-and-etfs-for-day-trading-1031371_FINAL-48091a4408564ad585a5e7aa58cea129.png?w=700)

In the world of trading, risk management is crucial to protect your capital and ensure long-term success. By implementing effective risk management strategies, traders can minimize losses and maximize profits. One key aspect of risk management is setting clear guidelines for managing risk and using tools like stop-loss orders to mitigate potential losses.

Utilizing Stop-Loss Orders

Stop-loss orders are essential tools for traders to limit their losses and protect their capital. These orders automatically trigger a sale when a security reaches a certain price, helping traders exit a position before losses escalate. By setting stop-loss orders at strategic levels based on technical analysis or support/resistance levels, traders can control their risk exposure and prevent emotional decision-making during volatile market conditions.

It is important for traders to set stop-loss orders based on their risk tolerance and trading strategy to effectively manage their risk exposure.

Diversifying Trading Portfolio, Best stocks to trade today

Diversification is another key risk management strategy that involves spreading your investments across different assets or sectors to reduce overall risk. By diversifying your trading portfolio, you can lower the impact of potential losses from a single security or market sector. This strategy helps offset losses in one asset with gains in another, creating a more balanced and resilient portfolio.

- Allocate capital across different asset classes such as stocks, bonds, commodities, and currencies to reduce correlation risk.

- Consider diversifying by industry sectors to minimize sector-specific risks and exposure to market fluctuations.

- Regularly review and rebalance your portfolio to ensure it aligns with your risk tolerance and investment goals.

In conclusion, mastering the art of trading stocks requires a combination of research, analysis, and sound risk management. By following the tips and strategies Artikeld in this guide, you can enhance your trading skills and increase your chances of success in the dynamic world of stock trading. Stay informed, stay disciplined, and watch your investments grow.

When it comes to day trading strategies, it’s crucial to have a solid plan in place. One effective approach is to focus on technical analysis and use tools like moving averages and RSI indicators. By staying disciplined and constantly monitoring market trends, traders can increase their chances of success. For more in-depth insights on day trading strategies , check out our comprehensive guide.

For those just starting out in the stock market, understanding the basics is key. Learning about different order types, market trends, and risk management is essential for beginners. Our guide on stock trading for beginners covers everything you need to know to kickstart your trading journey and make informed decisions.

Interested in swing trading but not sure where to begin? Swing trading involves holding positions for a few days to weeks, capitalizing on short- to medium-term market movements. Our guide on swing trading explained dives into the intricacies of this strategy and provides tips for maximizing profits while minimizing risks.