Stock volume analysis is a crucial aspect of financial markets, providing traders and investors with valuable insights into market trends and potential price movements. By delving into the intricacies of volume data, one can make more informed decisions and capitalize on trading opportunities.

In this comprehensive guide, we will explore the significance of stock volume analysis, different methods used to analyze volume, essential tools for the task, and how to interpret volume patterns for effective trading strategies.

Introduction to Stock Volume Analysis

Stock volume analysis is a critical tool used by traders and investors to assess the level of activity in a particular stock. It refers to the number of shares traded in a security over a specific period of time, typically on a daily basis. Understanding stock volume is essential as it provides valuable insights into market sentiment and helps in making informed decisions.

If you’re looking to get into the world of trading but don’t have a lot of capital to start with, learning how to trade penny stocks can be a great entry point. These low-priced stocks can offer high returns if approached strategically.

The Significance of Stock Volume

Stock volume is a crucial indicator in financial markets as it reflects the level of interest and participation in a particular stock. High volume often indicates strong market interest and can suggest potential price movements. Conversely, low volume may signal a lack of interest or uncertainty among market participants.

When it comes to investing, many people debate between cryptocurrency and stock trading. Both have their pros and cons, but cryptocurrency vs stock trading ultimately comes down to individual risk tolerance and investment goals.

Relationship Between Stock Volume and Price Movements

There is a strong relationship between stock volume and price movements. Generally, a significant increase in volume accompanied by a price rise can indicate bullish momentum, suggesting that the uptrend may continue. On the other hand, a decline in volume during a price increase might signal weakening momentum and potential reversal. It is essential to analyze stock volume in conjunction with price movements to gain a comprehensive understanding of market dynamics.

For those interested in a more short-term approach, swing trading explained can be a lucrative strategy. This method involves holding stocks for a short period, typically a few days to a few weeks, to capitalize on market fluctuations.

Types of Stock Volume Analysis

Stock volume analysis involves various methods that traders use to interpret and analyze volume data in the stock market. Understanding these different approaches can help investors make informed decisions based on trading volume patterns.

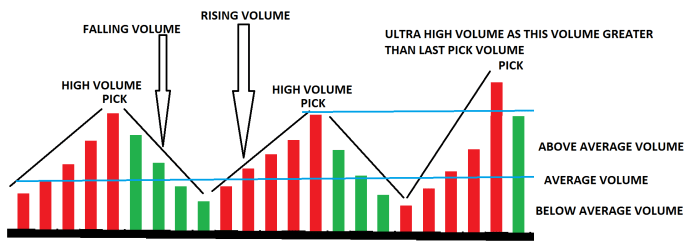

Volume Bars

Volume bars are a commonly used method for stock volume analysis. They visually represent the volume of shares traded during a specific time period, typically displayed as vertical bars on a price chart. Traders can analyze volume bars to identify potential buying or selling pressure in the market.

On-Balance Volume

On-Balance Volume (OBV) is a technical indicator that uses volume flow to predict changes in stock price. It calculates a running total of volume, adding the volume on up days and subtracting the volume on down days. Traders use OBV to confirm price trends and identify potential trend reversals.

Volume Moving Averages

Volume moving averages are used to smooth out fluctuations in volume data and identify trends over time. By calculating the average volume over a specific period, traders can determine whether trading activity is increasing or decreasing. This can help traders gauge market sentiment and make trading decisions accordingly.

Intraday Volume Analysis

Traders use intraday volume analysis to evaluate volume patterns within a single trading day. By analyzing volume data at different time intervals throughout the day, traders can identify short-term trends and potential trading opportunities. Intraday volume analysis is particularly useful for day traders looking to capitalize on short-term price movements.

Technical vs. Fundamental Analysts, Stock volume analysis

Technical analysts primarily focus on price and volume data to make trading decisions, believing that all relevant information is already reflected in stock prices. They use stock volume analysis to identify trends and patterns that can help predict future price movements. On the other hand, fundamental analysts rely on company financials and economic factors to evaluate the intrinsic value of a stock. While they may consider volume data, it is not the primary focus of their analysis.

Tools for Stock Volume Analysis

When it comes to analyzing stock volume, traders have access to a variety of tools and software that can help them make informed decisions. These tools provide valuable insights into market trends and can help traders predict potential price movements based on volume data.

Volume Indicators

Volume indicators play a crucial role in stock volume analysis by providing information about the strength of a price movement. Two popular volume indicators used by traders are Chaikin Money Flow (CMF) and Accumulation/Distribution.

– Chaikin Money Flow (CMF): This indicator combines price and volume to measure the buying and selling pressure in a stock. A positive CMF indicates buying pressure, while a negative CMF suggests selling pressure. Traders often use CMF to confirm the strength of a price trend.

– Accumulation/Distribution: This indicator evaluates the relationship between price and volume to determine whether a stock is being accumulated or distributed. It helps traders identify potential trend reversals by analyzing the flow of money into and out of a stock.

Platforms for Stock Volume Data

Traders can access stock volume data for analysis through various platforms that offer real-time market information. Some popular platforms where traders can find stock volume data include:

– Bloomberg Terminal: A professional platform widely used by financial professionals to access real-time market data, news, and analytics.

– Yahoo Finance: A free platform that provides stock quotes, news, and financial information, including volume data for individual stocks.

– TradingView: An online platform that offers advanced charting tools and real-time data for stocks, forex, and cryptocurrencies, including volume analysis features.

These tools and platforms play a crucial role in helping traders analyze stock volume effectively and make informed trading decisions based on volume data.

Interpreting Stock Volume Patterns

When analyzing stock volume patterns, it is important to look for key indicators that can provide insights into market trends and potential price movements. By understanding common volume patterns and how they interact with price action, investors can make more informed decisions when trading stocks.

Volume spikes are a common pattern that often indicates increased buying or selling activity. A sudden surge in volume can signal a shift in market sentiment and may precede a significant price movement. Traders can use volume spikes to confirm the strength of a trend or identify potential entry and exit points.

Trend confirmation is another important aspect of stock volume analysis. When volume increases in the direction of the prevailing trend, it can validate the momentum and sustainability of the trend. Conversely, declining volume during a price rally may suggest weakening market interest and a possible trend reversal.

Volume climax occurs when there is a sudden surge in trading volume followed by a sharp reversal in price. This pattern often signals a turning point in the market and can indicate the exhaustion of buying or selling pressure. Traders can use volume climax to anticipate potential reversals and adjust their trading strategies accordingly.

Examples of Volume Patterns

- Volume spikes can be seen during earnings announcements or major news events that impact a stock’s price.

- Trend confirmation is evident when volume increases as the stock continues to make higher highs and higher lows.

- Volume climax often occurs at key support or resistance levels, signaling a potential change in market direction.

In conclusion, mastering stock volume analysis can significantly enhance your trading prowess, allowing you to navigate the markets with confidence and precision. By understanding the nuances of volume data and its implications, you can stay ahead of market trends and make informed decisions that lead to success in the dynamic world of trading.