MACD explained for beginners provides a detailed exploration of the Moving Average Convergence Divergence indicator, offering insights into its components, calculations, and interpretation for novice traders looking to enhance their knowledge and skills.

In this guide, we will delve into the intricacies of MACD, shedding light on its relevance and significance in the world of trading.

Introduction to MACD

MACD stands for Moving Average Convergence Divergence. It is a popular technical analysis indicator used by traders to identify potential trends in the market. The MACD consists of three components: the MACD line, the signal line, and the histogram. Traders use MACD to generate buy and sell signals based on the crossovers between these lines.

Components of MACD

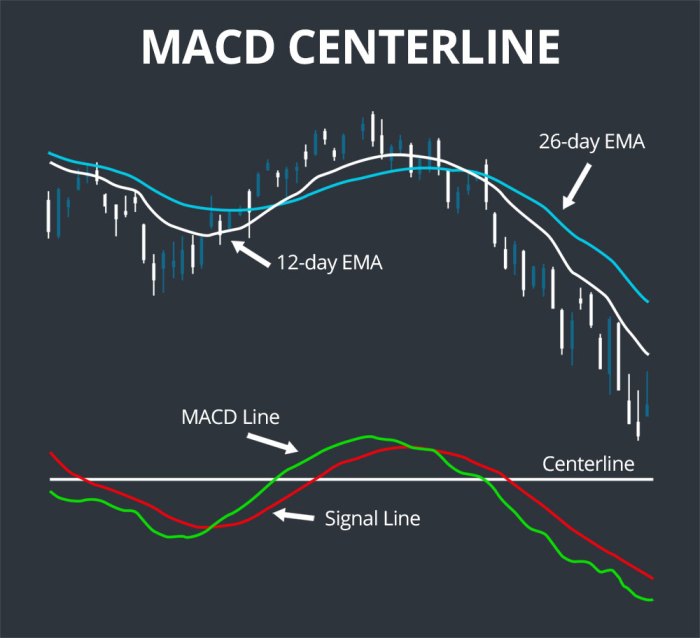

- The MACD line: This is the difference between the 26-period Exponential Moving Average (EMA) and the 12-period EMA.

- The Signal line: This is the 9-period EMA of the MACD line.

- The Histogram: This represents the difference between the MACD line and the Signal line.

Purpose of Using MACD in Trading, MACD explained for beginners

- Identifying Trend Reversals: Traders use MACD crossovers to identify potential trend reversals in the market.

- Confirming Trend Strength: MACD can also help confirm the strength of a trend by analyzing the distance between the MACD line and the Signal line.

- Generating Buy and Sell Signals: Traders use MACD crossovers and histogram patterns to generate buy and sell signals.

Calculation of MACD

:max_bytes(150000):strip_icc()/dotdash_Final_Moving_Average_Convergence_Divergence_MACD_Aug_2020-05-89bcc16eb76b4d158e0bcc00be800f2f.jpg?w=700)

MACD (Moving Average Convergence Divergence) is a popular technical indicator used by traders to identify trends and potential buy or sell signals in the market. The MACD is calculated using the following formula:

MACD Line = 12-period EMA – 26-period EMA

In this formula, EMA stands for Exponential Moving Average. The EMA is a type of moving average that gives more weight to recent price data, making it more responsive to current price movements compared to a simple moving average.

Significance of the Signal Line

The Signal Line is a 9-period EMA of the MACD Line. It is used to generate trading signals when it crosses above or below the MACD Line. When the MACD Line crosses above the Signal Line, it is considered a bullish signal, suggesting a potential uptrend in the market. On the other hand, when the MACD Line crosses below the Signal Line, it is seen as a bearish signal, indicating a potential downtrend.

By analyzing the relationship between the MACD Line and the Signal Line, traders can make informed decisions on when to enter or exit trades, based on the momentum and direction of the market.

Interpreting MACD: MACD Explained For Beginners

When it comes to interpreting the Moving Average Convergence Divergence (MACD) indicator, traders primarily focus on two key aspects: MACD crossovers and divergences between MACD and price action. These signals can provide valuable insights into potential trend reversals and market momentum.

MACD Crossovers

MACD crossovers occur when the MACD line crosses above or below the signal line. A bullish crossover happens when the MACD line moves above the signal line, indicating a potential uptrend. Conversely, a bearish crossover occurs when the MACD line falls below the signal line, signaling a possible downtrend. Traders often use these crossovers to make buy or sell decisions based on the direction of the crossover.

Divergence Between MACD and Price Action

Divergence between the MACD indicator and price action can also provide valuable insights. Bullish divergence occurs when the price makes lower lows, but the MACD makes higher lows, suggesting a potential trend reversal to the upside. On the other hand, bearish divergence occurs when the price makes higher highs, but the MACD makes lower highs, indicating a possible trend reversal to the downside. Traders use these divergences to anticipate changes in market direction.

MACD Histogram

The MACD histogram is a technical indicator derived from the Moving Average Convergence Divergence (MACD) and the signal line. It is used by traders to identify changes in the strength of a trend and potential trend reversals in the market.

Derivation of the MACD Histogram

The MACD histogram is calculated by finding the the difference between the MACD line and the signal line. This reveals the momentum of the trend, with positive values indicating bullish momentum and negative values indicating bearish momentum.

- The histogram is plotted as a series of vertical bars above or below the zero line, depending on whether the MACD line is above or below the signal line.

- When the histogram bars are increasing in height, it indicates that the trend is gaining momentum.

- Conversely, decreasing histogram bars suggest a loss of momentum in the trend.

Utilizing the MACD Histogram

Traders often use the MACD histogram as a confirmation tool for trend analysis. By observing the behavior of the histogram bars in relation to the zero line, traders can make more informed decisions about entering or exiting trades.

Traders may look for convergence or divergence between the MACD histogram and price action to confirm potential trend reversals.

- When the histogram crosses above the zero line, it signals a shift to bullish momentum, suggesting a potential buying opportunity.

- Conversely, a histogram crossing below the zero line indicates a shift to bearish momentum, signaling a possible selling opportunity.

- Additionally, the slope of the histogram bars can provide insights into the strength of the trend, with steeper inclines or declines indicating stronger momentum.

In conclusion, mastering MACD can be a valuable asset for beginners venturing into the realm of trading, providing them with a powerful tool to analyze market trends and make informed decisions.

When it comes to investing in the stock market, knowing how to buy and sell stocks is crucial. Understanding the process of placing orders, analyzing trends, and managing risks can help you make informed decisions.

For those new to investing, learning what stock trading entails is essential. It involves buying and selling shares of publicly traded companies on stock exchanges to generate profits.

Mastering how to read candlestick charts is a valuable skill for traders. These charts provide insights into price movements and can help predict future market trends.