Algorithmic trading for stocks involves using automated systems to make buying and selling decisions in the stock market, revolutionizing the way investors approach trading. As technology continues to advance, algorithmic trading has become an essential tool for maximizing profits and minimizing risks in the fast-paced world of stock trading.

Overview of Algorithmic Trading for Stocks

:max_bytes(150000):strip_icc()/dotdash_Final_Algorithmic_Trading_Apr_2020-01-59aa25326afd47edb2e847c0e18f8ce2.jpg?w=700)

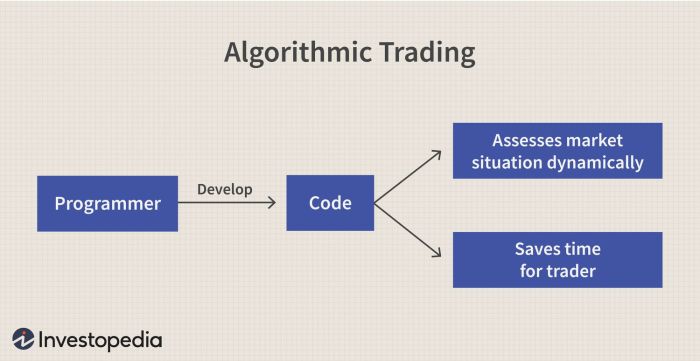

Algorithmic trading in the stock market involves the use of computer algorithms to make trading decisions at a speed and frequency that is impossible for a human trader. These algorithms are designed to analyze market data, execute trades, and manage risk without human intervention.

How Algorithms are Used in Trading Stocks

Algorithms in stock trading are programmed to follow specific rules and criteria to determine when to buy or sell securities. These rules can be based on various factors such as price movements, volume, technical indicators, or even news sentiment. By utilizing historical data and real-time information, algorithms can quickly identify trading opportunities and execute orders at optimal prices.

- High-Frequency Trading: One common use of algorithms in stock trading is high-frequency trading, where trades are executed within milliseconds to take advantage of small price discrepancies.

- Statistical Arbitrage: Algorithms can also be used for statistical arbitrage, which involves identifying mispricings in related securities and profiting from the price differences.

- Market Making: Some algorithms are designed to act as market makers, providing liquidity by continuously quoting bid and ask prices.

Benefits of Algorithmic Trading for Stock Investors

- Efficiency: Algorithmic trading eliminates human emotions from the trading process, leading to quicker and more efficient trade executions.

- Accuracy: Algorithms can analyze vast amounts of data and execute trades with precision, reducing the likelihood of errors.

- Diversification: Algorithmic trading allows investors to diversify their trading strategies and access different markets simultaneously.

- Risk Management: With predefined risk parameters, algorithms can help control risk and limit potential losses.

Types of Algorithmic Trading Strategies

Algorithmic trading strategies are crucial for navigating the complex world of stock markets. These strategies utilize mathematical models and automated systems to make trading decisions quickly and efficiently. Here are some common types of algorithmic trading strategies used for stocks:

1. Momentum Trading

Momentum trading is based on the belief that stocks that have been performing well will continue to perform well, and vice versa. Algorithms identify stocks with upward or downward price trends and execute trades accordingly.

2. Mean Reversion

Mean reversion strategies operate on the principle that stocks will eventually revert to their average price over time. Algorithms identify stocks that have deviated significantly from their mean price and place trades in anticipation of a correction.

3. Arbitrage Trading

Arbitrage trading involves exploiting price discrepancies of the same asset in different markets. Algorithms quickly identify these price differences and execute trades to profit from the inefficiencies.

4. Pairs Trading

Pairs trading involves simultaneously buying and selling two correlated securities to capitalize on temporary price divergences. Algorithms identify pairs of stocks that historically move together and take advantage of any deviations from their usual relationship.

High-Frequency Trading vs. Other Strategies

High-frequency trading (HFT) is a subset of algorithmic trading that relies on speed and high trading volumes to capitalize on small price discrepancies. While HFT focuses on executing a large number of trades in milliseconds, other algorithmic trading strategies like momentum, mean reversion, arbitrage, and pairs trading operate on different principles such as price trends, mean reversion, and market inefficiencies.

Examples of Successful Algorithmic Trading Strategies

One notable example of a successful algorithmic trading strategy is Renaissance Technologies’ Medallion Fund, which has consistently outperformed the market using a combination of quantitative models and algorithms. Another example is Citadel Securities, known for its high-frequency trading strategies that have generated significant profits in the stock market.

Factors Influencing Algorithmic Trading

When it comes to algorithmic trading in stock markets, there are several key factors that influence trading decisions. These factors play a crucial role in the success of algorithmic trading strategies and can impact the overall performance of trading algorithms.

Role of Market Data

Market data is one of the fundamental factors that influence algorithmic trading decisions. This includes information such as price movements, trading volume, bid-ask spreads, and other relevant data points. Algorithms analyze this data in real-time to identify trading opportunities and execute trades based on predefined parameters. The accuracy and timeliness of market data are essential for the effectiveness of algorithmic trading strategies.

News Sentiment and Technical Analysis

In addition to market data, news sentiment and technical analysis also play a significant role in algorithmic trading. News sentiment analysis involves monitoring news articles, social media posts, and other sources to gauge market sentiment and identify potential trading opportunities. Technical analysis, on the other hand, involves using historical price data and technical indicators to forecast future price movements. Algorithmic trading strategies often incorporate both news sentiment and technical analysis to make informed trading decisions.

Impact of Economic Indicators

External factors such as economic indicators can have a profound impact on algorithmic trading strategies. Economic indicators like GDP growth, inflation rates, and employment data can influence market sentiment and drive price movements. Algorithmic traders often adjust their strategies based on the release of key economic indicators to capitalize on market trends and opportunities. Understanding the impact of economic indicators is crucial for developing successful algorithmic trading strategies in stock markets.

Risks and Challenges in Algorithmic Trading for Stocks

Algorithmic trading in the stock market comes with its own set of risks and challenges that traders need to be aware of and prepared for. Understanding these potential pitfalls is crucial for successful implementation of algorithmic trading strategies.

Potential Risks Associated with Algorithmic Trading

- Market Volatility: Rapid price fluctuations can trigger algorithms to execute trades at unfavorable prices.

- Technology Risks: System failures, connectivity issues, and data inaccuracies can lead to significant financial losses.

- Regulatory Risks: Compliance with regulations and changes in market structure can impact the effectiveness of trading strategies.

Challenges in Algorithmic Trading

- System Failures: Technical glitches or downtime can disrupt trading activities and result in missed opportunities.

- Data Inaccuracies: Incorrect or delayed data feeds can lead to faulty decision-making and suboptimal trading outcomes.

- Regulatory Issues: Adhering to complex regulatory requirements and ensuring compliance can be challenging for algorithmic traders.

Strategies for Mitigating Risks and Overcoming Challenges, Algorithmic trading for stocks

- Implement Robust Risk Management Protocols: Setting predefined risk limits, monitoring systems continuously, and having fail-safe mechanisms in place can help mitigate potential risks.

- Use Quality Data Sources: Ensuring the accuracy and timeliness of data inputs is essential for making informed trading decisions.

- Stay Informed About Regulatory Changes: Keeping abreast of regulatory developments and adapting trading strategies accordingly can help navigate regulatory challenges effectively.

Tools and Technologies for Algorithmic Trading

Algorithmic trading for stocks relies heavily on various tools and technologies to execute trading strategies efficiently. These tools play a crucial role in analyzing market data, making decisions, and placing trades in real-time.

Popular Tools and Technologies

- Trading Platforms: Advanced trading platforms like MetaTrader, NinjaTrader, and TradeStation provide the infrastructure for algorithmic trading.

- APIs: Application Programming Interfaces (APIs) allow traders to connect their algorithms to the market data and execute trades automatically.

- Data Analytics Tools: Tools like Python, R, and MATLAB are commonly used for analyzing large datasets and developing complex trading strategies.

- Execution Management Systems (EMS): EMS platforms help traders manage their orders, optimize execution, and minimize market impact.

Role of Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) have revolutionized algorithmic trading by enabling algorithms to learn from historical data, adapt to changing market conditions, and improve trading performance over time. These technologies help in identifying patterns, predicting market movements, and optimizing trading strategies for better results.

Importance of Backtesting and Optimization Tools

- Backtesting Tools: Backtesting allows traders to evaluate the performance of their strategies using historical data. Tools like QuantConnect and Backtrader help in testing algorithms before deploying them in live trading.

- Optimization Tools: Optimization tools help traders fine-tune their strategies by adjusting parameters, risk levels, and other variables to maximize returns and minimize risks.

In conclusion, Algorithmic trading for stocks offers a glimpse into the future of investment strategies, showcasing the power of technology in shaping the financial landscape. By leveraging algorithms and cutting-edge tools, investors can stay ahead of the curve and make informed decisions in an ever-evolving market environment.

When diving into the world of investing, understanding stock market basics for beginners is crucial. From learning how the stock market operates to grasping key terminology, this knowledge sets a solid foundation for any new investor. By exploring resources like Stock market basics for beginners , individuals can gain the confidence needed to start their investment journey.

For those interested in actively participating in the market, knowing how to trade stocks online is essential. Online trading platforms offer convenience and accessibility, allowing individuals to buy and sell stocks with ease. By following guides such as How to trade stocks online , beginners can navigate these platforms effectively.

Understanding what stock trading entails is key for anyone looking to invest in the market. Stock trading involves the buying and selling of stocks, with the goal of generating profit. By delving into resources like What is stock trading? , individuals can grasp the fundamental concepts behind this practice.