Home insurance for high-risk properties sets the stage for safeguarding your valuable assets amidst potential risks and uncertainties. Dive into the world of specialized coverage and mitigation strategies to secure your property.

Understanding High-Risk Properties

When it comes to home insurance, high-risk properties pose unique challenges for both homeowners and insurance providers. These properties are characterized by factors that increase the likelihood of damage, loss, or liability, leading to higher premiums or potential coverage limitations.

Factors Contributing to High-Risk Properties

- Location: Properties located in areas prone to natural disasters such as floods, earthquakes, hurricanes, or wildfires are considered high-risk due to the increased likelihood of damage.

- Building Materials: Homes constructed with flammable materials or outdated building standards can pose a higher risk of fire or structural damage, impacting insurance coverage.

- Previous Claims History: Properties with a history of frequent insurance claims, whether due to weather-related incidents, theft, or vandalism, are often classified as high-risk.

Importance of Home Insurance for High-Risk Properties

Home insurance is crucial for high-risk properties as they are more susceptible to damage or loss due to various factors such as location, building materials, and past claim history. Without adequate insurance coverage, owners of high-risk properties may face significant financial burdens in case of unexpected events.

Homeowners living in flood-prone areas should consider getting flood insurance to protect their homes and belongings. This type of insurance can help cover the cost of repairs and replacements in case of flood damage. By having flood insurance, homeowners can mitigate the financial risks associated with flood-related disasters.

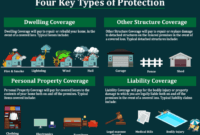

Coverage Options for High-Risk Properties

When it comes to home insurance for high-risk properties, there are specialized coverage options available that cater to the unique needs of these properties. This can include coverage for natural disasters, vandalism, or liability claims that may be more common in high-risk areas.

For homeowners living in earthquake-prone regions, having adequate earthquake insurance coverage is crucial. This type of insurance can help cover the cost of repairs and rebuilding in the event of an earthquake. By investing in earthquake insurance, homeowners can protect their homes and finances from the devastating effects of earthquakes.

- Extended Coverage: High-risk properties often require additional coverage options beyond the standard policy to protect against specific risks associated with the property.

- Flood Insurance: Properties located in flood-prone areas may need separate flood insurance coverage as it is not typically included in standard home insurance policies.

- Earthquake Insurance: For properties in earthquake-prone regions, having earthquake insurance is essential to cover damages caused by seismic activities.

Consequences of Not Having Adequate Insurance for High-Risk Properties

Not having adequate insurance for a high-risk property can lead to severe financial consequences for the property owner. In the event of a disaster or damage, they may have to bear the full cost of repairs or replacement, which can be exorbitant and may even lead to financial ruin.

When it comes to protecting your rental properties, having landlord insurance is essential. This type of insurance provides coverage for property damage, liability protection, and loss of rental income. By investing in landlord insurance, you can safeguard your investment and have peace of mind knowing that you are protected in case of unforeseen events.

Having the right insurance coverage for a high-risk property provides peace of mind and financial protection against unforeseen events.

Specialized Insurance Providers

When it comes to insuring high-risk properties, not all insurance companies are created equal. Some providers specialize in offering coverage for properties that are considered high-risk due to various factors such as location, age, or condition. These specialized insurance providers have the expertise and experience to assess risk accurately and tailor policies to meet the unique needs of high-risk property owners.

Identifying Specialized Providers

- One well-known specialized insurance provider for high-risk properties is Lloyd’s of London. They have a long history of providing coverage for unique and high-risk properties that traditional insurers may not cover.

- Another specialized provider is Foremost Insurance, which offers coverage for properties with risks such as a history of claims, poor maintenance, or non-standard construction.

Premiums, Deductibles, and Coverage Limits

- Specialized insurance providers often charge higher premiums for coverage on high-risk properties compared to traditional insurers. This is because the risks associated with these properties are greater, requiring more comprehensive coverage.

- Deductibles for high-risk properties with specialized providers may also be higher to offset the increased risk. Property owners should be prepared to pay a higher out-of-pocket expense in the event of a claim.

- Specialized providers may offer higher coverage limits to ensure that high-risk properties are adequately protected in case of a major loss. This can provide property owners with peace of mind knowing that their assets are secure.

Risk Assessment and Tailored Policies, Home insurance for high-risk properties

- Specialized insurance providers assess risk factors specific to high-risk properties, such as location, construction materials, and previous claims history. This detailed assessment allows them to accurately price coverage and determine appropriate policy terms.

- By tailoring policies to the unique needs of high-risk properties, specialized providers can offer coverage that addresses specific risks and vulnerabilities. This customized approach ensures that property owners have the protection they need.

Mitigation Strategies for High-Risk Properties: Home Insurance For High-risk Properties

When it comes to high-risk properties, homeowners can implement various mitigation strategies to reduce the risks associated with their homes. By taking proactive measures, homeowners can not only enhance the safety and security of their properties but also potentially lower their insurance premiums.

Upgrades and Renovations

One effective way to mitigate risks for high-risk properties is to invest in upgrades and renovations. By improving the overall condition of the property, such as updating the electrical system, roof, or plumbing, homeowners can reduce the likelihood of damage from hazards like fires or water leaks. Insurance providers often view well-maintained properties more favorably, which can lead to lower insurance premiums.

Security Systems

Installing security systems, such as alarms, cameras, and motion sensors, can significantly enhance the safety of a high-risk property. These systems not only deter potential intruders but also provide homeowners with early warnings in case of emergencies. Insurance companies may offer discounts on premiums for properties with robust security measures in place.

Inspections and Risk Assessments

Regular inspections and risk assessments play a crucial role in determining insurance eligibility and rates for high-risk properties. By identifying potential hazards and vulnerabilities, homeowners can address issues proactively and demonstrate their commitment to maintaining a safe living environment. Insurance providers may offer more competitive rates to homeowners who conduct thorough inspections and take steps to mitigate risks.

Claim Process for High-Risk Properties

When it comes to filing a claim for a high-risk property, there are specific steps that homeowners need to follow to ensure a smooth process. Due to the unique challenges that high-risk properties present, the claims process may differ from that of standard properties. Homeowners may encounter various obstacles and complications when trying to file a claim for their high-risk property.

Steps in Filing a Claim for High-Risk Properties

- 1. Contact your insurance provider: The first step is to notify your insurance company about the incident and initiate the claims process.

- 2. Document the damage: Take photos and videos of the damage to provide visual evidence for your claim.

- 3. Obtain estimates: Get estimates from contractors or repair professionals to assess the cost of repairs or replacements.

- 4. Submit your claim: Fill out the necessary claim forms and submit all relevant documentation to your insurance provider.

- 5. Work with an adjuster: An insurance adjuster will assess the damage and determine the coverage amount based on your policy.

- 6. Await approval: Your insurance company will review your claim and approve the necessary funds for repairs or replacements.

- 7. Complete repairs: Once your claim is approved, you can proceed with the repairs and restoration of your high-risk property.

Challenges in Filing Claims for High-Risk Properties

- 1. Higher premiums: Homeowners of high-risk properties may face higher premiums and deductibles, making it more costly to file a claim.

- 2. Limited coverage: Insurance policies for high-risk properties may have limitations on coverage, leaving homeowners with gaps in protection.

- 3. Increased scrutiny: Insurance companies may scrutinize claims for high-risk properties more closely, leading to delays or denials in coverage.

- 4. Complex claims process: Due to the unique nature of high-risk properties, the claims process can be more complex and time-consuming for homeowners.

- 5. Mitigation requirements: Insurance providers may require homeowners to implement specific mitigation strategies before approving a claim for a high-risk property.

Industry Regulations and Compliance

When it comes to home insurance for high-risk properties, there are specific regulations and requirements in place to ensure the safety and protection of both the property and its occupants. Compliance with safety standards and building codes plays a crucial role in determining insurance coverage for these properties. Additionally, homeowners have legal obligations to fulfill when insuring a high-risk property.

Regulations and Requirements

- Insurance companies may have specific guidelines regarding the types of high-risk properties they are willing to cover.

- Some states or regions may have regulations in place that dictate the minimum insurance coverage required for high-risk properties.

- Homeowners may be required to provide documentation proving that necessary safety measures have been implemented on the property.

Impact of Compliance on Insurance Coverage

- Compliance with safety standards and building codes can lead to lower insurance premiums for high-risk properties.

- Failure to comply with these regulations may result in limited coverage or even denial of insurance claims in case of an incident.

- Regular inspections to ensure ongoing compliance with safety standards may be required by insurance providers.

Legal Obligations for Homeowners

- Homeowners must disclose all relevant information about the property when applying for insurance, including any high-risk factors.

- In some cases, homeowners may be required to make specific upgrades or improvements to the property to meet safety standards and comply with regulations.

- Failing to fulfill legal obligations related to insurance coverage for high-risk properties can have legal consequences and financial implications.

In conclusion, ensuring adequate insurance for high-risk properties is not just a choice but a necessity to shield against unforeseen events. Stay informed, stay protected, and enjoy peace of mind knowing your investment is secure.