Home insurance liability coverage takes center stage, offering vital protection for homeowners. From legal expenses to medical bills, understanding this coverage is crucial for safeguarding your assets.

In this comprehensive guide, we will delve into the nuances of home insurance liability coverage, shedding light on its significance and various aspects that every homeowner should be aware of.

Overview of Home Insurance Liability Coverage

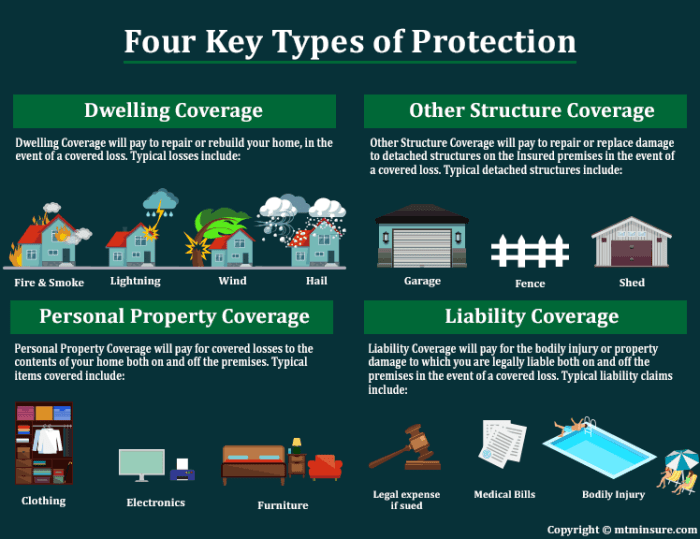

Home insurance liability coverage is a crucial component of a homeowner’s insurance policy that protects the policyholder in case someone is injured on their property or if they accidentally damage someone else’s property. This coverage helps pay for legal fees, medical expenses, and damages resulting from a covered liability claim.

Examples of Situations Where Liability Coverage Comes Into Play

- If a visitor slips and falls on your icy driveway during the winter and sustains injuries requiring medical treatment, your liability coverage can help cover their medical expenses.

- If your dog bites a neighbor or damages their property, your liability coverage can help pay for their medical bills or repair costs.

- In the event that a guest at your home accidentally starts a fire that spreads to a neighbor’s property, your liability coverage can help cover the damages caused by the fire.

Importance of Having Liability Coverage in a Home Insurance Policy

Having liability coverage in a home insurance policy is essential as it provides financial protection and peace of mind in case of unforeseen accidents or incidents on your property. Without liability coverage, you could be personally responsible for paying for legal fees, medical expenses, or damages out of pocket, which could be financially devastating. It is important to ensure that you have adequate liability coverage to protect yourself and your assets in case of liability claims.

Types of Liability Coverage

When it comes to home insurance liability coverage, there are two main types to consider: personal liability coverage and medical payments coverage. These two forms of coverage offer protection in different scenarios and can help safeguard you against financial risks in the event of accidents or injuries on your property.

Personal Liability Coverage

Personal liability coverage is designed to protect you in case someone is injured on your property or if you accidentally damage someone else’s property. This coverage can help cover legal fees, medical expenses, and other costs associated with a lawsuit if you are found liable for causing harm to another person or their belongings. It provides a safety net in situations where you may be held responsible for accidents that occur on your property.

Medical Payments Coverage

On the other hand, medical payments coverage helps with medical expenses for guests who are injured on your property, regardless of who is at fault. This coverage can help cover immediate medical costs such as ambulance rides, hospital stays, surgeries, and other medical treatments that may be needed as a result of an accident on your property. Medical payments coverage can offer peace of mind knowing that your guests’ medical expenses are taken care of, without the need for a lengthy legal process to determine fault.

Coverage Limits and Factors Affecting Liability Coverage

When it comes to liability coverage in home insurance, understanding coverage limits and the factors affecting them is crucial for proper protection. Let’s delve into how coverage limits work and what influences the amount of liability coverage needed.

Coverage Limits for Liability Coverage

Insurance policies typically have set limits on the amount of liability coverage they provide. These limits represent the maximum amount the insurance company will pay out for covered claims. It’s essential to review these limits to ensure they align with your financial situation and potential risks.

Factors Affecting Liability Coverage

- Property Value: The value of your home can impact the amount of liability coverage needed. Higher property values may require increased coverage limits to adequately protect your assets.

- Personal Assets: Consider your total assets, including savings, investments, and valuable possessions, when determining liability coverage limits. You want to ensure you have enough coverage to protect these assets in the event of a lawsuit.

- Risk Factors: Factors such as having a swimming pool, trampoline, or dog breed known for aggression can increase your liability risk. These factors may necessitate higher coverage limits to mitigate potential lawsuits resulting from accidents on your property.

- Legal Requirements: Some states have minimum liability coverage requirements for home insurance. Ensure you meet these legal obligations while also considering your individual needs for additional coverage.

Reviewing and Adjusting Coverage Limits, Home insurance liability coverage

It’s important to periodically review your liability coverage limits to ensure they remain adequate. Life changes, such as purchasing new assets or making renovations to your home, can impact your coverage needs. Regularly reassessing your coverage limits can help you maintain proper protection against potential liabilities.

Additional Liability Coverage Options: Home Insurance Liability Coverage

When it comes to home insurance liability coverage, homeowners have the option to enhance their protection by considering additional coverage options. These options can provide added security and peace of mind in case of unexpected events.

Umbrella Liability Coverage

Umbrella liability coverage is a type of policy that extends the liability protection provided by your standard home insurance. It offers an extra layer of coverage beyond the limits of your primary policy, typically starting at $1 million. This additional coverage can be crucial in protecting your assets in the event of a lawsuit or claim that exceeds your basic policy limits.

Endorsements for Specific Liability Coverage

Homeowners can also opt for endorsements, which are additions to their standard policy that provide specific liability coverage. For example, you can add coverage for identity theft, dog bites, or swimming pool accidents. Endorsements allow homeowners to tailor their coverage to their individual needs and risks, ensuring comprehensive protection.

Examples of Additional Liability Coverage Options

- Personal Injury Liability: Covers claims related to libel, slander, or invasion of privacy.

- Medical Payments: Provides coverage for medical expenses if someone is injured on your property, regardless of fault.

- Limited Water Damage Liability: Protects against water damage caused by plumbing issues.

- Additional Living Expenses: Covers costs if you need to temporarily relocate due to damage to your home.

In conclusion, home insurance liability coverage is not just a safety net but a shield that safeguards your home and finances. By grasping the intricacies of this coverage, you can make informed decisions to protect what matters most.

When it comes to protecting your mobile home, it’s crucial to get accurate mobile home insurance quotes to ensure you have the right coverage.

As a landlord, safeguarding your rental properties is a top priority. Explore the options for comprehensive landlord insurance for rental properties to protect your investments.

Living in an earthquake-prone area requires proper preparation. Understand the importance of having sufficient earthquake insurance coverage to protect your home and belongings.