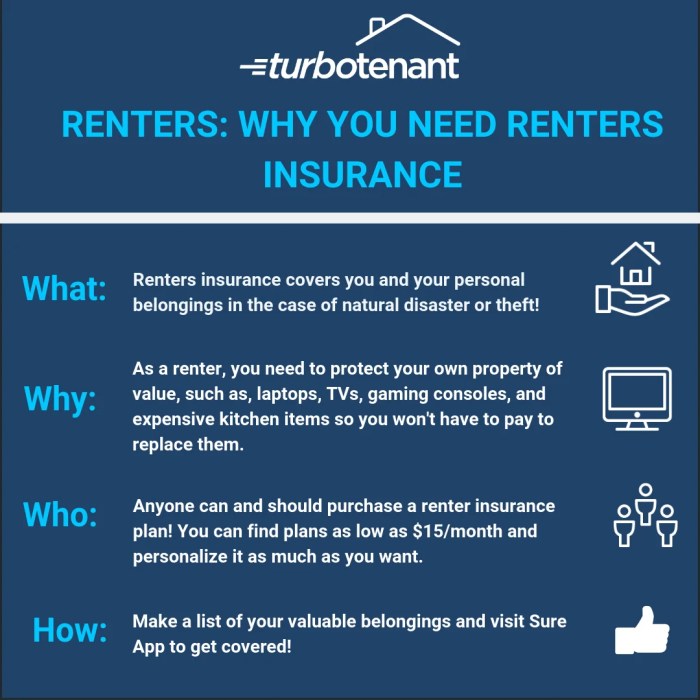

What is renters insurance and do I need it? This crucial question often arises for tenants seeking to protect their belongings and liabilities. Let’s delve into the intricacies of renters insurance to shed light on its significance and necessity.

Renters insurance goes beyond just safeguarding personal items; it offers a safety net in unforeseen circumstances. As we explore the nuances of this insurance type, you’ll uncover the key reasons why having renters insurance is a prudent choice for tenants.

What is renters insurance?

Renters insurance is a type of insurance policy designed to protect individuals who rent their living space. While landlords typically have insurance to cover the physical structure of the property, renters insurance is specifically tailored to protect the personal belongings and liability of the tenant.

Coverage offered by renters insurance

- Renters insurance typically covers personal belongings such as furniture, electronics, clothing, and other valuables in case of theft, fire, or other covered perils.

- Liability coverage is also included in renters insurance, protecting the policyholder from legal responsibility for injuries or damages that occur within the rented property.

- Additional living expenses coverage may be provided in case the rented property becomes uninhabitable due to a covered event, helping with temporary accommodation costs.

Differences between renters insurance and other types of insurance

- Renters insurance differs from homeowners insurance in that it does not cover the physical structure of the property, as that is the landlord’s responsibility. Instead, renters insurance focuses on the tenant’s personal belongings and liability.

- Landlord insurance, on the other hand, is designed to protect the property owner from financial losses related to the rental property itself, such as structural damage or loss of rental income.

- While homeowners and landlord insurance are typically required by lenders or property management companies, renters insurance is often optional but highly recommended for tenants to protect their personal property and liability.

Importance of renters insurance

Renters insurance is a crucial protection for tenants, offering financial security and peace of mind in the face of unforeseen events. While landlords typically have insurance for the property itself, renters insurance covers the personal belongings and liability of the tenant in case of theft, damage, or accidents.

Benefits of renters insurance

- Property coverage: Renters insurance can help replace or repair personal belongings such as furniture, electronics, and clothing in case of damage or theft.

- Liability protection: In the event that a visitor is injured in your rental unit, renters insurance can cover medical expenses and legal fees if you are found responsible.

- Additional living expenses: If your rental unit becomes uninhabitable due to a covered event, renters insurance can help cover the cost of temporary accommodations.

- Peace of mind: Knowing that you are financially protected in case of emergencies or accidents can provide a sense of security and relief.

Real-life scenarios

Imagine coming home to find your apartment flooded due to a burst pipe. With renters insurance, you can file a claim to cover the cost of replacing your damaged belongings and temporary housing while repairs are being made.

In another scenario, if a visitor slips and falls in your apartment and decides to sue you for medical expenses, renters insurance can step in to cover legal fees and potential settlement costs, protecting your finances from a significant loss.

Cost considerations

When it comes to renters insurance, the cost can vary depending on several factors. Understanding what influences the cost and how to find affordable options without compromising coverage is crucial for renters.

Factors influencing the cost of renters insurance

- The location of your rental property: Urban areas or regions prone to natural disasters may have higher premiums.

- The coverage amount: Opting for higher coverage limits will increase the cost of your renters insurance.

- Your deductible: Choosing a higher deductible can lower your premium but means you’ll pay more out of pocket in the event of a claim.

- Your credit score: Some insurance companies use credit scores to determine rates, so maintaining good credit can help lower costs.

Comparison of pricing options and coverage levels

- Basic coverage: Provides protection for personal belongings and liability, usually at a lower cost.

- Comprehensive coverage: Offers additional protection for specific risks like water damage or identity theft, but comes at a higher price.

- Bundling discounts: Some insurers offer discounts if you bundle renters insurance with other policies like auto insurance.

Tips for finding affordable renters insurance

- Shop around: Compare quotes from multiple insurance companies to find the best rate for your needs.

- Consider higher deductibles: Increasing your deductible can lower your premium, but make sure you can afford the out-of-pocket costs.

- Ask about discounts: Inquire about available discounts for things like safety features in your rental unit or being claim-free.

- Review your coverage annually: Make sure your coverage still meets your needs and adjust as necessary to avoid overpaying.

Coverage Details: What Is Renters Insurance And Do I Need It?

When it comes to renters insurance, understanding the different components of coverage is crucial in order to protect your assets and mitigate risks. Let’s break down the key aspects of renters insurance coverage and provide examples of when each type of coverage would come into play.

Personal Property Coverage, What is renters insurance and do I need it?

Personal property coverage is designed to protect your belongings in the event of theft, fire, or other covered perils. This type of coverage typically includes items such as furniture, electronics, clothing, and jewelry. For example, if your apartment is broken into and your laptop and television are stolen, personal property coverage would help reimburse you for the cost of replacing these items.

Liability Coverage

Liability coverage is important in case someone is injured while on your rental property. This coverage can help pay for medical expenses or legal fees if you are found responsible for the injury. For instance, if a visitor slips and falls in your apartment and decides to sue you for medical expenses, liability coverage would help cover these costs.

Additional Living Expenses Coverage

Additional living expenses coverage can provide financial assistance if you are temporarily displaced from your rental property due to a covered event, such as a fire or natural disaster. This coverage can help with costs like hotel bills, food, and other living expenses while your rental is being repaired. For example, if a fire damages your apartment and you need to stay in a hotel while repairs are being made, additional living expenses coverage would help cover these costs.

Hypothetical Scenario: Comprehensive Coverage

Imagine a scenario where a fire breaks out in your rental unit, causing extensive damage to your personal belongings and rendering the apartment uninhabitable. Without renters insurance, you would be left to cover the costs of replacing your belongings and finding temporary housing on your own. However, with comprehensive renters insurance that includes personal property, liability, and additional living expenses coverage, you would have the financial support needed to recover from the incident without facing a significant financial burden.

Additional considerations

When it comes to renters insurance, there are some additional considerations that tenants should keep in mind to ensure they have the right coverage for their needs.

Optional Add-Ons or Endorsements

Tenants can consider adding optional endorsements or add-ons to their renters insurance policy for enhanced protection. These additional coverages can include:

- Identity theft protection

- Flood insurance

- Earthquake coverage

- Jewelry or valuable items coverage

- Additional liability coverage

It’s essential to review your policy and discuss with your insurance provider to understand the options available for customization.

Common Misconceptions

There are some common misconceptions about renters insurance that can lead tenants to overlook its importance. It’s crucial to clarify these misconceptions, such as:

- Renters insurance is expensive – in reality, it’s quite affordable, with the average cost being around $15 to $30 per month.

- Landlords’ insurance covers tenant belongings – landlord insurance typically only covers the structure, not the tenant’s personal property.

- Renters insurance is only for expensive items – renters insurance covers all personal belongings, regardless of their value.

By understanding the facts about renters insurance, tenants can make informed decisions about protecting their assets.

Insurance Needs Evaluation Checklist

Before purchasing renters insurance, individuals should evaluate their insurance needs to ensure they get the right coverage. Here is a checklist to help with this evaluation:

- Assess the value of your personal belongings

- Determine your liability coverage needs

- Consider any additional risks in your area (floods, earthquakes, etc.)

- Review the policy limits and coverage exclusions

- Understand the deductible and premium costs

By going through this checklist, tenants can tailor their renters insurance policy to suit their specific requirements and budget.

In conclusion, understanding the intricacies of renters insurance is vital for tenants looking to secure their belongings and liabilities. By grasping the importance and benefits of this insurance, individuals can make informed decisions to protect themselves financially and emotionally.

When it comes to protecting your mobile home, getting mobile home insurance quotes is crucial. This type of insurance provides coverage for your mobile home, personal belongings, and liability protection.

Homeowners living in flood-prone areas should consider getting flood insurance for homeowners to protect their property from potential water damage. This insurance can help cover the cost of repairs and replacements due to flooding.

For property owners renting out their properties, having landlord insurance policies is essential. This type of insurance provides coverage for rental property damage, liability protection, and loss of rental income.