Flood insurance for homeowners is a crucial safeguard against unexpected water-related disasters. From defining flood insurance to exploring coverage options, this topic delves into the essentials homeowners need to know.

Discover how flood insurance can make a difference in protecting your most valuable asset – your home.

What is Flood Insurance for Homeowners?

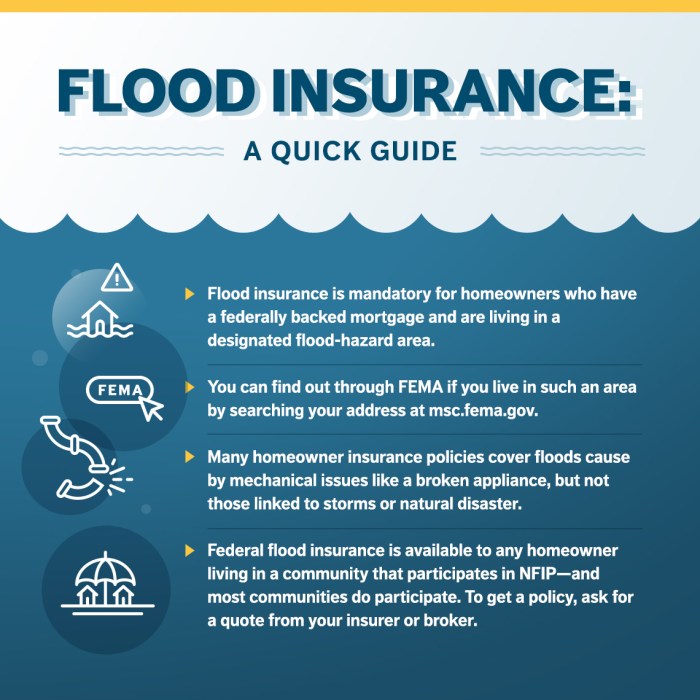

Flood insurance for homeowners is a specialized type of insurance policy that provides financial protection in the event of flooding caused by natural disasters or other water-related incidents. This type of insurance is separate from standard homeowners insurance and is essential for those living in flood-prone areas.

Importance of Flood Insurance

Having flood insurance is crucial for homeowners because standard homeowners insurance policies typically do not cover damage caused by floods. Without flood insurance, homeowners may face significant financial losses if their property is damaged by flooding. This insurance provides peace of mind and ensures that homeowners are financially protected in the event of a flood.

- One example where flood insurance can benefit homeowners is in the aftermath of a hurricane or severe storm that causes flooding. Without flood insurance, homeowners may have to bear the costs of repairing or rebuilding their homes themselves.

- Another example is in situations where heavy rainfall leads to flooding in a neighborhood. Flood insurance can help cover the costs of water damage to the structure of the home, as well as personal belongings inside.

- Additionally, areas near rivers, lakes, or coastal regions are at higher risk of flooding, making flood insurance a necessity for homeowners in these locations.

Types of Flood Insurance Coverage: Flood Insurance For Homeowners

When it comes to flood insurance coverage for homeowners, there are different types of policies available to protect your property. It’s essential to understand the various options to ensure you have the right coverage in place.

Enhance the beauty of your garden with stylish pergola design ideas. Pergolas not only provide shade and a cozy outdoor living space, but they can also serve as a focal point in your garden, adding architectural interest and enhancing the overall design of your outdoor area.

Standard Flood Insurance Policies

Standard flood insurance policies typically cover the building structure and its foundation, as well as electrical and plumbing systems, HVAC systems, appliances, carpeting, and permanently installed fixtures. Contents coverage may also be included for personal belongings such as furniture, clothing, and electronics.

Transform your outdoor space with style using creative outdoor wall decor ideas. From vibrant murals to intricate metalwork, there are endless possibilities to add personality and charm to your outdoor walls, creating a visually appealing environment for your family and guests.

Additional Coverage Options, Flood insurance for homeowners

Homeowners can opt for additional coverage options to enhance their protection in case of a flood. This may include coverage for basement improvements, detached structures on the property, and temporary living expenses if the home becomes uninhabitable due to flood damage.

Enhance your outdoor space with artistic designs by incorporating garden sculptures for landscaping. These sculptures can add a touch of elegance and creativity to your garden, making it a truly unique and inviting space for relaxation and entertainment.

Scenarios for Each Type of Coverage

- Standard Flood Insurance: In a scenario where heavy rains cause flooding in your area, a standard flood insurance policy would cover the repair or rebuilding of your home’s structure and damaged belongings.

- Additional Coverage Options: If your property has a basement that is prone to flooding, opting for coverage for basement improvements can help cover the cost of repairing or replacing items stored in the basement.

- Temporary Living Expenses: In the event that your home is severely damaged by a flood and deemed uninhabitable, having coverage for temporary living expenses can help cover the costs of alternative accommodations while your home is being repaired.

Factors Affecting Flood Insurance Premiums

When it comes to flood insurance for homeowners, several factors come into play when determining the premiums. Understanding these factors can help homeowners make informed decisions to potentially lower their insurance costs.

Location: One of the key factors that influence flood insurance premiums is the location of the property. Homes located in high-risk flood zones will typically have higher premiums compared to those in low or moderate-risk areas. The proximity to bodies of water, historical flood data, and elevation levels all play a role in determining the risk associated with the property.

Property Value: The value of the property itself is another important factor in calculating flood insurance premiums. More expensive homes will generally have higher premiums since the cost of repairing or replacing the property in case of a flood will be greater.

Flood Risk Zones: Properties located in FEMA-designated flood risk zones will have different premium rates based on the level of risk associated with that specific zone. Homes in Special Flood Hazard Areas (SFHAs) are at a higher risk of flooding and will have higher premiums compared to those in moderate to low-risk zones.

Tips to Lower Premiums: There are several ways homeowners can potentially lower their flood insurance premiums. One effective method is to elevate the property above the Base Flood Elevation (BFE) to reduce the risk of flooding. Installing flood vents, maintaining a proper drainage system, and securing the property against flood damage can also help lower premiums. Additionally, working with a qualified insurance agent to understand the coverage options and discounts available can lead to cost savings in the long run.

Making a Flood Insurance Claim

When disaster strikes and your home is affected by a flood, it’s crucial to understand the steps involved in making a flood insurance claim. By following the proper procedures and providing the necessary documentation, homeowners can ensure a smoother and more efficient claims process.

Steps for Making a Flood Insurance Claim

- Contact your insurance company: Notify your insurance provider as soon as possible to initiate the claims process.

- Evaluate the damage: Document the extent of the damage to your property and belongings with photographs or videos.

- File a Proof of Loss: Submit a sworn statement detailing the items damaged or lost during the flood.

- Wait for an adjuster: An insurance adjuster will assess the damage and determine the coverage amount for your claim.

- Receive payment: Once the claim is approved, you will receive payment to cover the damages based on your policy coverage.

Documentation Required for a Flood Insurance Claim

- Proof of Loss form: This document Artikels the items damaged or lost in the flood and their estimated value.

- Receipts and invoices: Keep records of any repairs, replacements, or expenses related to the flood damage.

- Photographic evidence: Capture images of the damage to support your claim during the assessment process.

- Policies and contracts: Provide copies of your insurance policies and any relevant contracts for review.

Tips for Filing and Settling a Flood Insurance Claim

- Act quickly: Notify your insurance company promptly and begin documenting the damage right away.

- Communicate clearly: Stay in touch with your insurance adjuster and provide any requested information promptly.

- Review your policy: Understand what is covered and excluded in your flood insurance policy to avoid any surprises during the claims process.

- Keep detailed records: Maintain organized records of all communication, expenses, and documentation related to your claim.

Importance of Flood Insurance in High-Risk Areas

Flood insurance plays a crucial role in protecting homeowners residing in high-risk flood zones. These areas are prone to flooding, and without adequate insurance coverage, homeowners can face devastating financial consequences in the event of a flood.

Significance of Flood Insurance in High-Risk Areas

- Having flood insurance in high-risk areas provides financial protection against the costly damages caused by floods.

- It ensures that homeowners can recover and rebuild their properties without bearing the full financial burden on their own.

- Without flood insurance, homeowners in high-risk areas may struggle to afford repairs and face the risk of losing their homes altogether.

Consequences of Not Having Flood Insurance in High-Risk Areas

- Homeowners without flood insurance in high-risk areas may experience severe financial strain in the aftermath of a flood, as they would have to cover repair costs out of pocket.

- Lack of insurance can lead to significant property damage, displacement, and emotional distress for homeowners in flood-prone regions.

- Without insurance, homeowners may have difficulty securing loans or financial assistance to rebuild their homes after a flood.

Real-Life Examples of Homeowners Benefitting from Flood Insurance

- In 2017, Hurricane Harvey caused catastrophic flooding in Houston, Texas. Homeowners with flood insurance were able to receive compensation for their losses and begin the process of rebuilding their homes.

- Following Hurricane Katrina in 2005, homeowners in New Orleans who had flood insurance were better equipped to recover and restore their properties compared to those without insurance.

- In coastal regions prone to storm surges, homeowners who invested in flood insurance have been able to protect their assets and minimize financial hardships in the face of natural disasters.

In conclusion, securing flood insurance for your home is not just a choice but a smart investment in safeguarding your property. Stay informed, stay protected.